Main Affect of 10-12 months US Treasury Yield

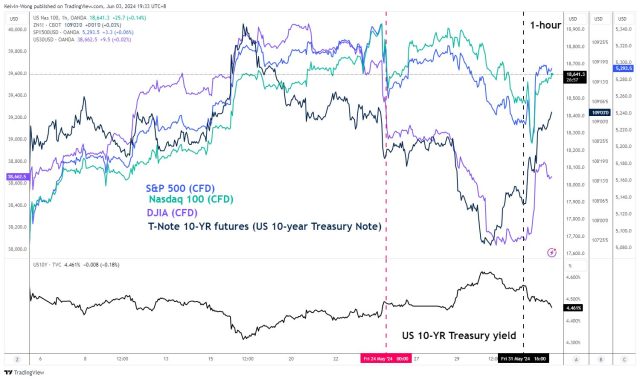

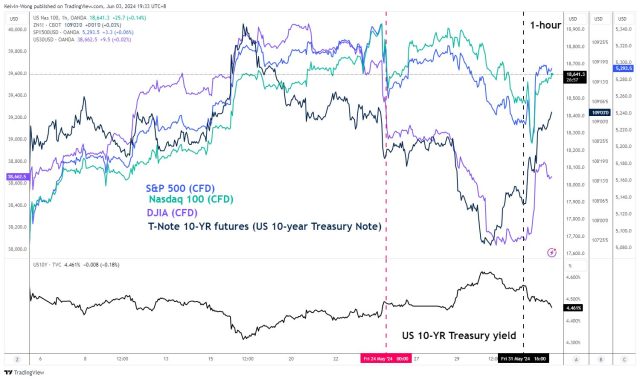

The 10-year US Treasury yield has grow to be a key consider dictating the brief to medium-term actions of main US inventory indices. On Might 31, key intraday bullish reversals within the S&P 500, Nasdaq 100, and Dow Jones had been pushed by an earlier rally within the 10-year Treasury Notice futures that started within the European session.

Watch the important thing short-term assist degree of 18,340 on the Nasdaq 100. The Nasdaq 100 reached a contemporary intraday all-time excessive of 18,907 on Might 23, boosted by Nvidia’s robust Q1 earnings and optimistic Q2 income steerage.

Influence of Momentum and Earnings on Market Tendencies

Whereas firm-based earnings are vital, the macro issue has now taken the lead since Might 24. This may be understood by inspecting the actions of the 10-year US Treasury yield and main US inventory indices. From Might 24 to Might 29, the 10-year Treasury yield rose by 15 foundation factors to a four-week excessive of 4.62%. Throughout the identical interval, main US inventory indices declined: S&P 500 (-1.31%), Nasdaq 100 (-1.43%), and Dow Jones (-2.45%).

Why Larger US Treasury Yields Have an effect on Shares

Final Friday’s key bullish reversal in US inventory indices was led by 10-year US Treasury Notice futures

Larger US Treasury yields can negatively influence US inventory indices. An increase in longer-term US Treasury yields, particularly above the 5% resistance degree, can set off risk-off habits amongst market individuals. This results in increased borrowing prices for customers and companies, doubtlessly lowering revenue margins and the variety of earnings upgrades from analysts.

Moreover, the S&P 500’s present 12-month ahead P/E ratio of 20.3, above its 10-year common of 17.8, is perhaps arduous to maintain if the 10-year yield continues to rise. A shrinking fairness threat premium, evaluating the S&P 500 earnings yield in opposition to the 10-year yield, might make US equities much less enticing in comparison with Treasury bonds.

Intraday Bullish Reversals and Constructive Momentum

On Might 31, main US inventory indices erased intraday losses and rallied strongly into the shut, with features recorded within the S&P 500 (+0.80%) and Dow Jones (+1.51%), whereas the Nasdaq 100 recovered from an earlier loss. These bullish strikes had been led by a reversal within the 10-year US Treasury Notice futures, which noticed an increase in value resulting from a discount within the 10-year yield (see Fig 1).

Analyzing Momentum in 10-12 months Treasury Notice Futures

The 10-year US Treasury Notice futures’ motion is essential resulting from its direct correlation with main US inventory indices. The each day RSI momentum indicator for the futures reveals “increased lows” and has not reached the overbought area, suggesting potential bullish momentum (see Fig 2).

If the medium-term assist at 107-23 holds, the following resistance ranges are at 110.12 (200-day shifting common) and 111-08 (descending trendline since Dec 27, 2023).

Nasdaq 100 Rebounds Above Key Common

The Nasdaq 100 managed to commerce above the 20-day shifting common on Might 31, forming a bullish “Dragonfly Doji” candlestick sample, indicating a possible revival of its bullish development since April 18, 2024 (see Fig 3).

Key Ranges to Watch on Nasdaq 100

Monitor the 18,340 short-term pivotal assist. A transfer above the 18,830 resistance might goal intermediate resistances at 18,990/19,055 and 19,160/19,180 (see Fig 4).

On the draw back, failure to carry at 18,340 might result in a decline in the direction of 18,100 (50-day shifting common) and additional to 17,810 as the important thing medium-term assist.