Financial Knowledge Underwhelms

A mixture of weaker-than-expected financial information and dovish feedback from Federal Reserve Chair Jerome Powell brought on the U.S. greenback to decline.

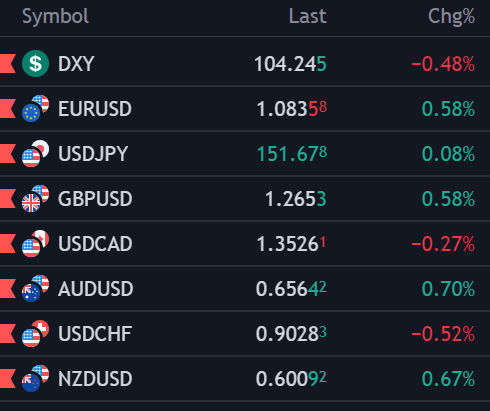

With a 0.48% decline, the DXY index—which gauges the power of the greenback relative to a basket of currencies—moved away from its latest multi-month highs.

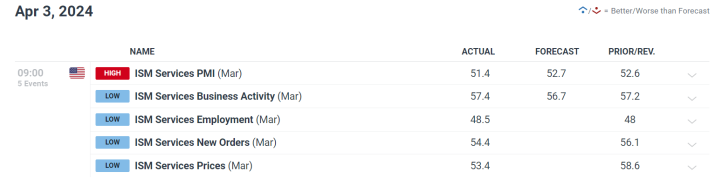

The weak March ISM Companies PMI, which signaled a slowdown within the providers sector—a significant a part of the US GDP—was a main contributing issue to this fall.

Powell’s Cautious Method

Regardless of market expectations for easing in 2024, Jerome Powell emphasised the Federal Reserve’s continued cautious strategy to fee cuts in an tackle on the Stanford Enterprise, Authorities, and Society Discussion board.

Powell underlined that earlier than contemplating fee adjustments, there should be extra convincing proof that inflation is headed towards the Fed’s 2% goal.

His remarks reveal his unwavering dedication to placing a steadiness between the risks of untimely fee cuts and people of an overly restrictive financial coverage.

Give attention to Labor Market Knowledge

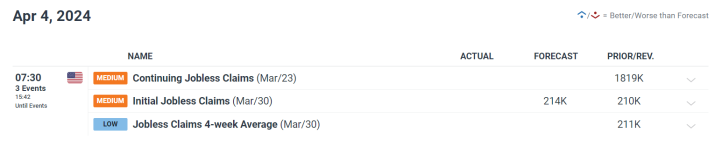

The subsequent nonfarm payrolls report and the U.S. unemployment claims information will now be the main focus of consideration as they’re broadly watched for clues in regards to the state of the labor market in the USA.

Preliminary jobless claims are anticipated to point out a minor improve for the week ending March 30.

These numbers are essential since they supply direct details about the state of the labor market and, consequently, about any adjustments to the Federal Reserve’s financial coverage.

Technical and Market Views

If the present losses within the U.S. greenback index persist, assist could also be discovered on the 104.00 degree, which is indicated by the intersection of the 50% Fibonacci retracement and a short-term ascending trendline.

Alternatively, a bullish market reversal would come from the psychological 105.00 degree.

Market individuals proceed to pay shut consideration to those technical ranges, adjusting their plans in response to statements about coverage and attainable adjustments in market sentiment.

Fed Officers Echo Powell’s Sentiment

Powell’s cautious stance was repeated by different Federal Reserve officers, comparable to Raphael Bostic, President of the Atlanta Fed, who mentioned that any fee cuts would most likely wait till the fourth quarter of 2024.

All Fed members agree that data-driven policymaking is essential, with inflation and labor market dynamics enjoying a serious function in influencing future choices.

Last Ideas

Merchants should comprehend the sophisticated relationships between labor market information, inflation, and Federal Reserve coverage choices as they navigate the present financial panorama.

Current statements by Jerome Powell and miserable financial information spotlight the cautious steadiness that the Fed goals to maintain.

To successfully react to market swings, merchants must be alert as new information turns into out there and incorporate technical evaluation and macroeconomic elements into their ways.

Within the upcoming months, the trajectory of the US greenback and market expectations will likely be enormously influenced by the Fed’s remarks and the altering financial indicators.

The buying and selling group will likely be intently observing these developments to evaluate the attainable impression on foreign money markets and wider monetary landscapes, as vital labor and inflation information are about to be launched.