Dealer Positions and Market Tendencies

EUR/CHF

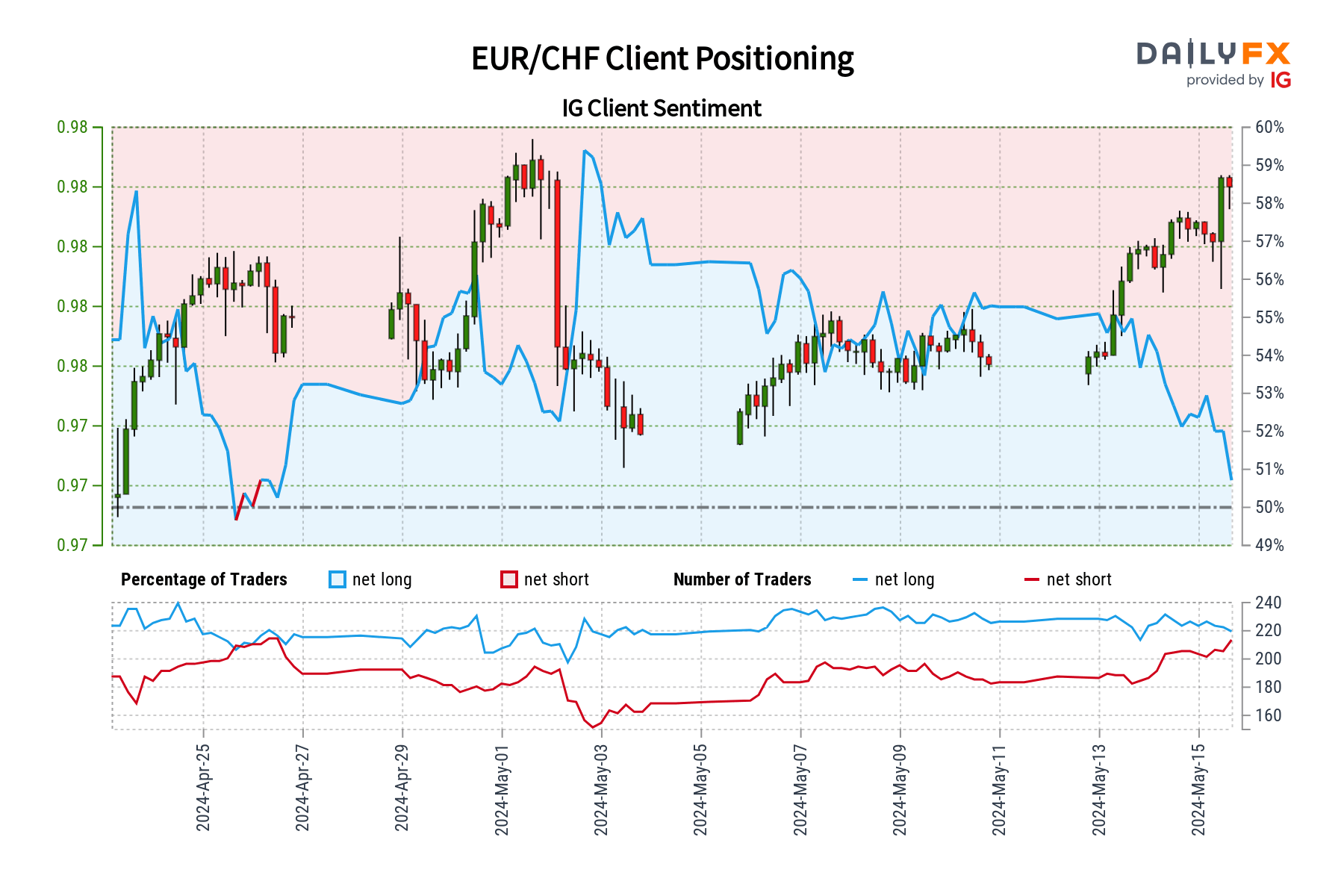

Present retail dealer information signifies that 49.18% of merchants are net-long, with the short-to-long ratio at 1.03 to 1. Since April 25, 2024, when EUR/CHF was priced close to 0.98, the market has seen a shift with merchants sustaining a net-short place. Regardless of this, the worth has elevated by 0.34% since that date.

The share of merchants net-long has decreased by 6.67% since yesterday and 10.64% from final week, whereas the share of merchants net-short has risen by 6.37% since yesterday and 13.02% from final week.

Adopting a contrarian perspective to market sentiment, the continuing net-short positioning amongst merchants suggests potential upward motion for EUR/CHF costs.

Evaluation and Outlook

The evaluation underscores a notable shift, with merchants now net-short on EUR/CHF for the primary time since late April. The rise in net-short positions each from the day past and over the previous week aligns with our contrarian bullish outlook for EUR/CHF, indicating a probability of continued value will increase primarily based on present dealer sentiment and up to date traits.

The put up EUR/CHF Sentiment Evaluation: Shift to Internet-Brief appeared first on Dumb Little Man.