Within the fast-paced world of foreign money buying and selling, discerning merchants should comprehend market sentiment and incorporate contrarian strategies.

This analysis seems on the sentiment and technical positions of three main US greenback pairs: USD/JPY, NZD/USD, and USD/CAD, and offers an in depth market perspective to assist merchants navigate these advanced markets.

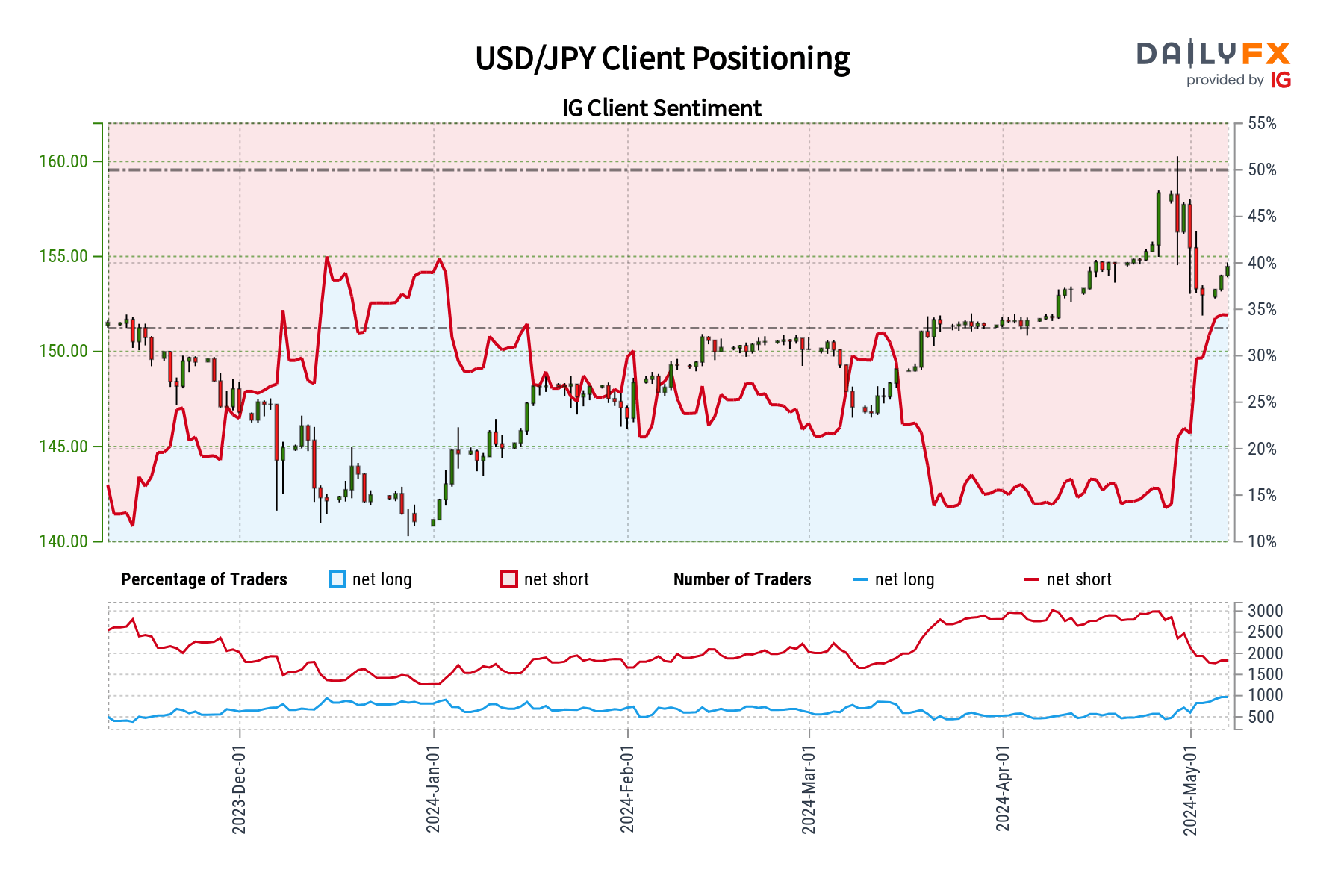

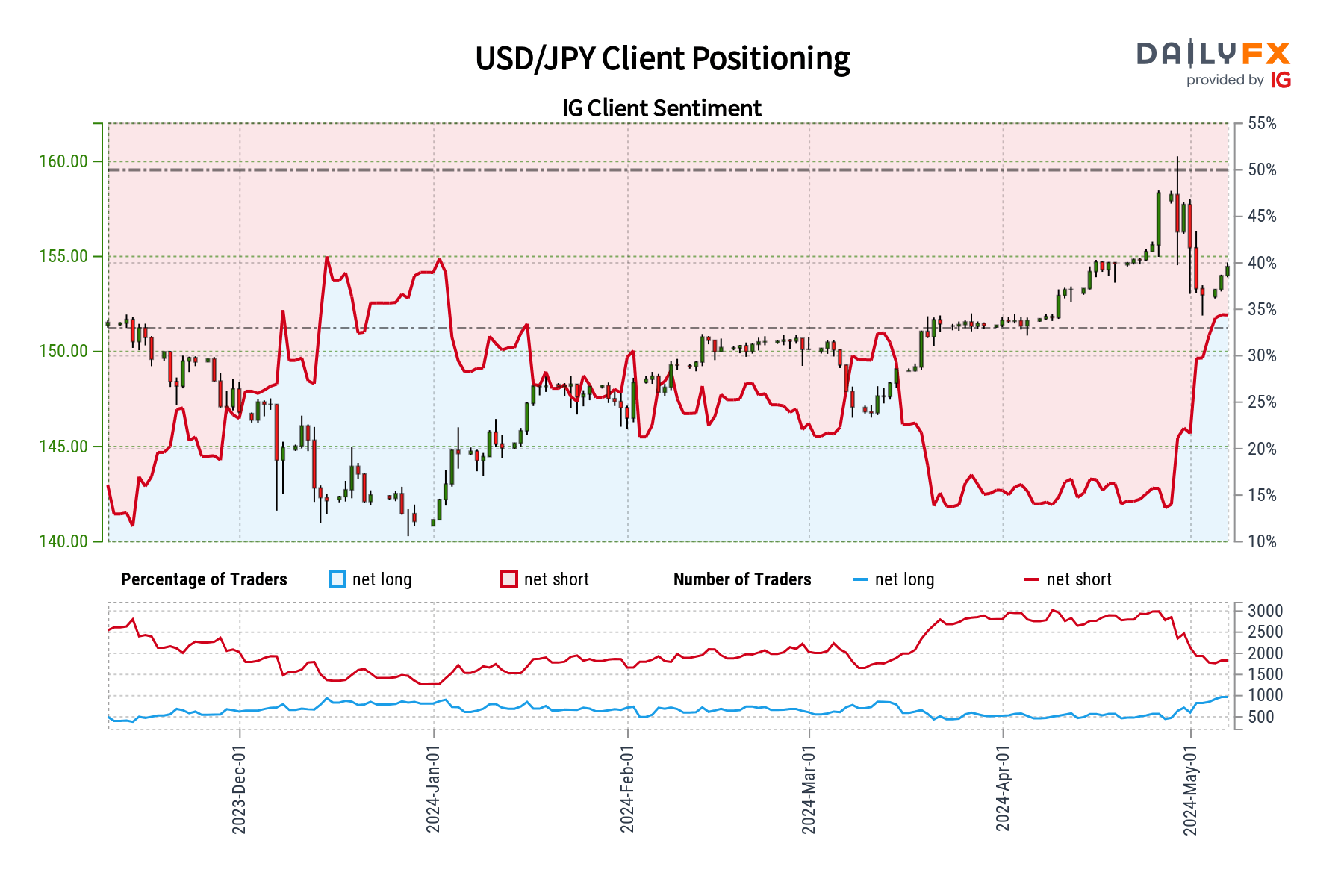

USD/JPY Sentiment and Outlook

IG consumer sentiment information point out a damaging tilt for the USD/JPY, with 66.90% of merchants holding net-short positions. A major short-to-long ratio of two.02 to 1 signifies a potential upside from a contrarian standpoint.

Nevertheless, a 3.20% day-to-day improve in shorts in opposition to a 25.37% decline over the week creates complicated indicators, leading to a impartial short-term bias for the USD/JPY. Contrarian concepts have to be matched with technical and basic evaluation.

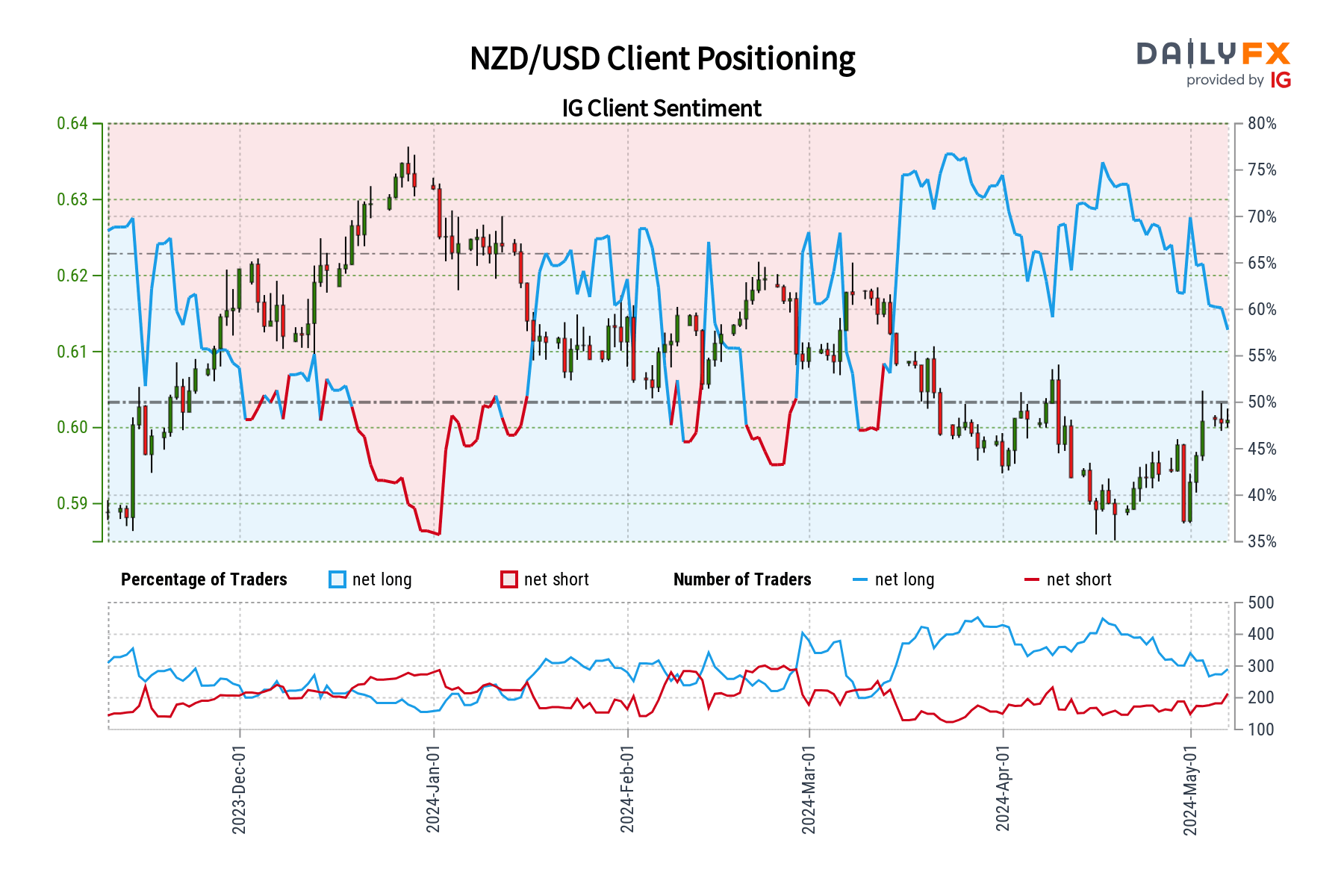

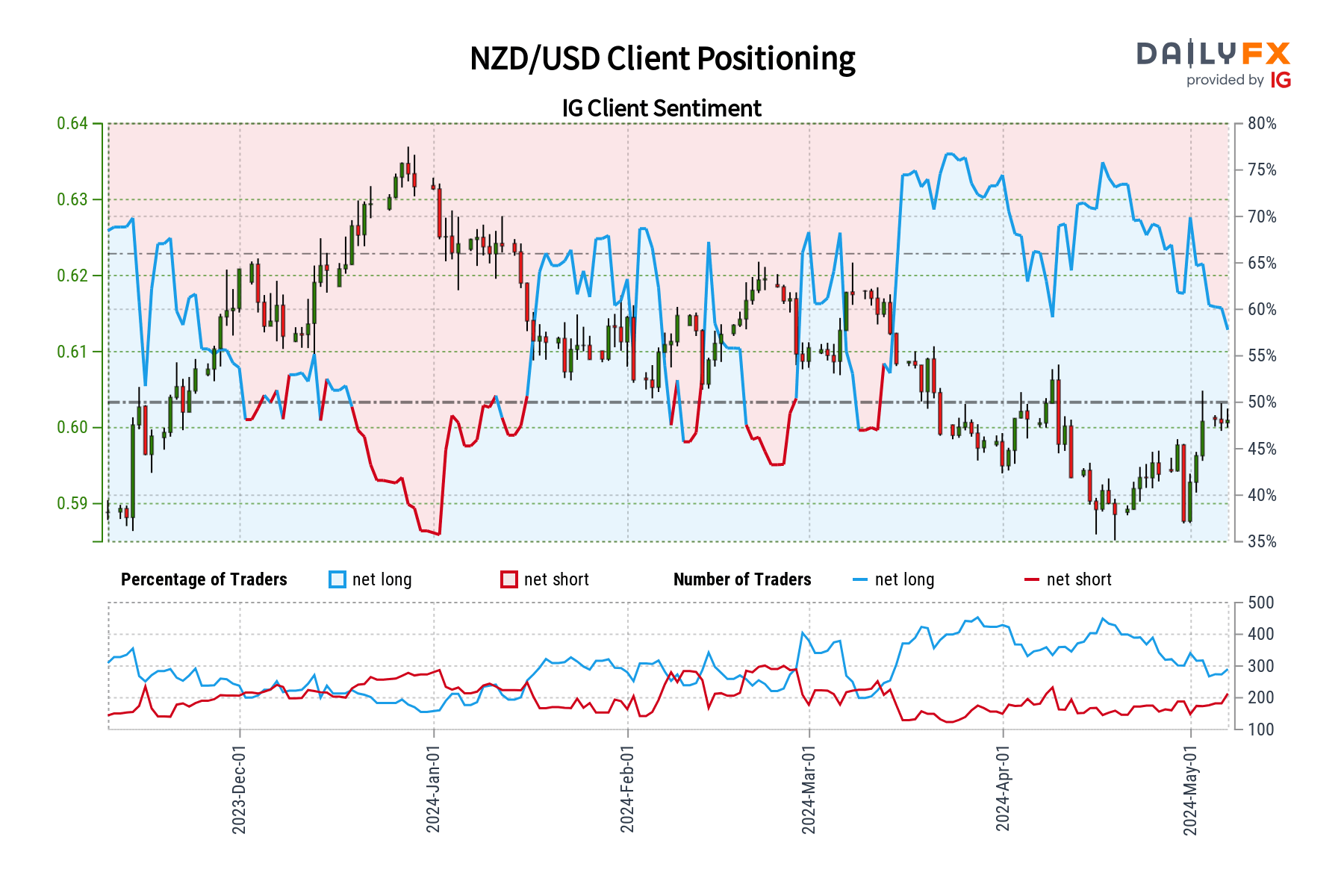

NZD/USD Sentiment and Outlook

For the NZD/USD, 56.13% of merchants are net-long, exhibiting a bullish angle. Nevertheless, a 3.30% day by day and 17.00% weekly decline in internet lengthy positions means that bullish momentum is fading, pointing to a possible near-term fall.

Use sentiment and market evaluation to forecast development reversals.

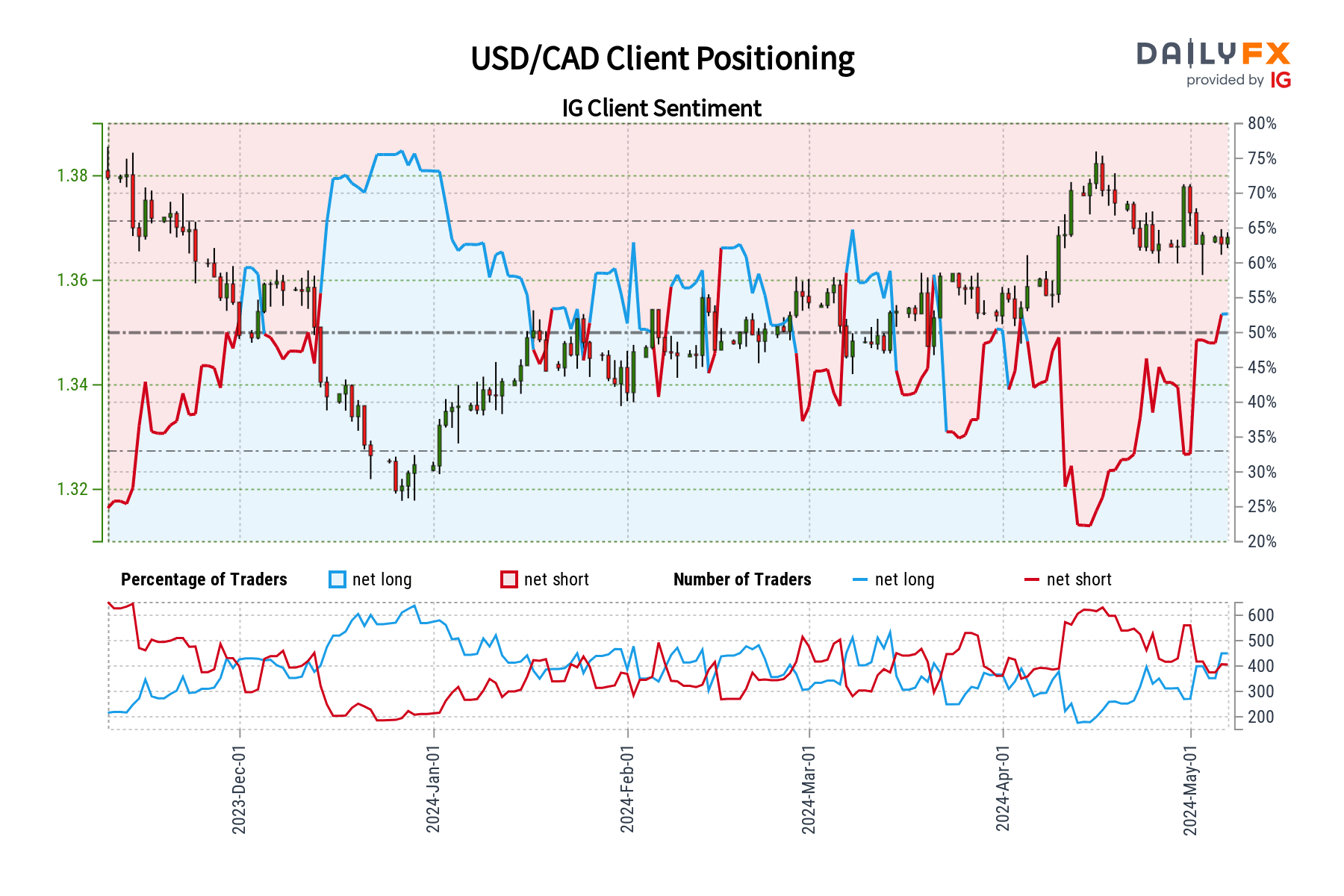

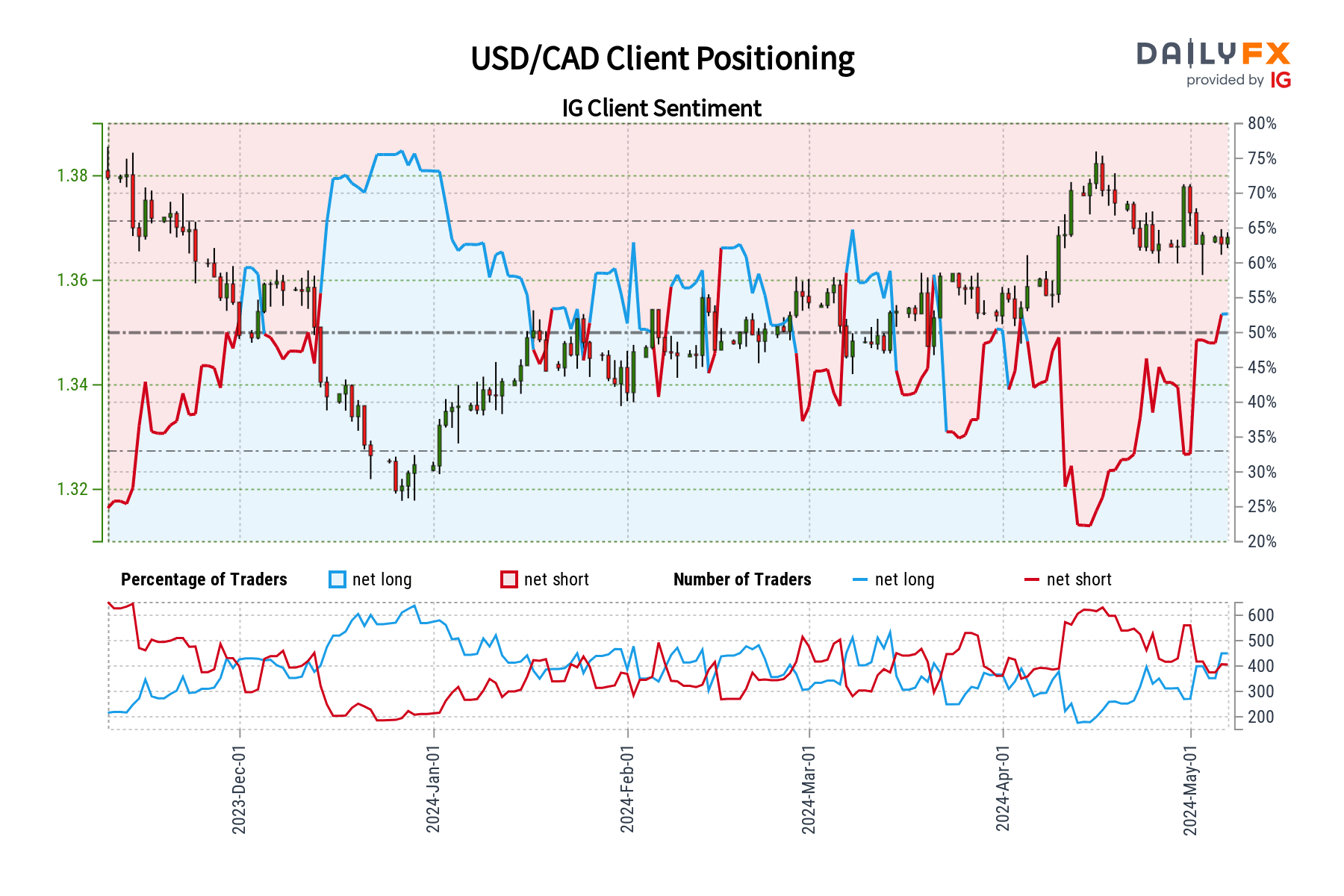

USD/CAD Sentiment and Outlook

Merchants are barely extra optimistic about USD/CAD, with 50.64% holding net-long positions. An 11.00% improve in internet longs per day and a 28.78% improve per week point out an rising bullish sentiment, which may point out a short-term decline.

For strategic buying and selling, mix contrarian indicators with different analyses.

U.S. Greenback Index (DX) Futures Evaluation

On the technical entrance, the U.S. Greenback Index fell 0.380, or -0.39%, to 98.081. The index examined a very important assist zone between 97.920 and 97.470, indicating a small restoration if these ranges maintain.

Following a profitable maintain, key retracement goals embody 98.315, 98.355, and 98.520, which could result in extra upward momentum.

Financial Influences and Fed’s Place

Economically, US Treasury yields fell to new lows, with the 10-year yield falling to 1.116%, signaling a surge in risk-averse habits within the wake of the coronavirus outbreak.

The Federal Reserve stays ready to take motion to assist the financial system, with the fed funds market absolutely anticipating a fee minimize on the upcoming March coverage assembly.

Such financial concerns are essential in figuring out greenback power and must be repeatedly studied by merchants.

Conclusion

For merchants, combining sentiment evaluation with a robust understanding of technical and basic indicators creates a strong basis for navigating the USD markets. Whereas contrarian indicators can establish possible reversals, they shouldn’t be employed alone.

To make sound buying and selling selections, keep updated on financial modifications and technical indicators. The USD’s trajectory remains to be intimately linked to financial indicators and market sentiment, needing a cautious and responsive buying and selling technique.