|

|

AximTrade Overview

Foreign exchange brokers play an important position within the world monetary markets, appearing as intermediaries that enable merchants and buyers to purchase and promote currencies. AximTrade stands out as a notable participant on this discipline, distinguished by its regulatory compliance and distinctive choices. Duly regulated by the ASIC and SVGFSA, AximTrade has cemented its popularity on the worldwide stage by delivering unparalleled companies, cutting-edge options, and extremely aggressive buying and selling circumstances.

Our assessment dives deep into AximTrade, spotlighting its standout options and areas that will want enchancment. We goal to furnish a complete analysis, specializing in the dealer’s distinctive promoting propositions. This evaluation is geared in the direction of offering readers with very important details about AximTrade’s varied account choices, deposit and withdrawal processes, fee constructions, and extra, mixing professional evaluation with actual dealer suggestions.

The objective of this assessment is to supply a balanced view of AximTrade, empowering you with the insights wanted to determine if it aligns together with your buying and selling necessities. By inspecting each the benefits and potential drawbacks, our goal is to help you in making an knowledgeable resolution relating to selecting AximTrade as your go-to brokerage service supplier.

What’s AximTrade?

AximTrade is acknowledged as a distinguished foreign exchange dealer within the monetary markets, catering to a variety of buying and selling wants. The dealer is acclaimed for its use of the MT4 foreign currency trading platform, which is taken into account the trade normal for foreign exchange and CFD buying and selling. Providing a various portfolio, AximTrade.com supplies entry to over 30 foreign exchange foreign money pairs, fairness, gold, and silver, presenting a wide range of choices for private funding and buying and selling.

Working beneath stringent regulatory frameworks, AximTrade is absolutely regulated in Australia and New Zealand, jurisdictions identified for his or her sturdy monetary laws and reliable authorities businesses. These present a security web for merchants in case of disputes with the dealer. Furthermore, AximTrade maintains an offshore entity in Saint Vincent and the Grenadines, famous for its extra lenient regulatory atmosphere for foreign exchange brokers.

The regulatory atmosphere considerably impacts buying and selling circumstances resembling leverage. AximTrade provides totally different leverage caps relying on the entity a dealer is registered with. For example, Australian laws prohibit leverage to a most of 1:30, whereas its entities in New Zealand and Saint Vincent and the Grenadines supply a lot increased leverage, as much as an astonishing 1:3,000. Distinctive to AximTrade is the “Infinite Leverage Account,” enabling merchants to primarily borrow a vast quantity of buying and selling capital, highlighting the dealer’s dedication to offering versatile buying and selling circumstances.

Security and Safety of AximTrade

The security and safety of AximTrade have been completely vetted, with insights gathered from intensive analysis by Dumb Little Man. As a multifaceted foreign exchange dealer, AximTrade Group encompasses varied entities, every regulated in several jurisdictions to make sure dealer security. AximTrade Pty Restricted falls beneath the oversight of the Australian Securities and Investments Fee (ASIC), establishing a powerful regulatory basis. Moreover, Huntington Providers Restricted, a New Zealand-based IBC, is permitted as a Monetary Service Supplier (FSP), whereas AximTrade LLC is regulated by the Monetary Providers Authority of Saint Vincent and the Grenadines and the Nationwide Futures Affiliation.

To additional safeguard consumer funds, AximTrade implements essential monetary safety measures. Every consumer’s funds are segregated, transferred to separate financial institution accounts, making certain safety from unexpected firm dangers. The dealer additionally provides damaging steadiness safety, a vital function that stops shoppers from dropping more cash than they’ve deposited. This mechanism is pivotal in sustaining the monetary well-being of merchants.

Furthermore, the dealer’s mother or father firm, Thara Heights Proprietor’s Company, has a longstanding operational historical past since 2010, reinforcing its stability and reliability within the monetary sector. AximTrade additionally accommodates trendy monetary practices by accepting digital wallets and cryptocurrency for fund deposits and withdrawals, catering to the various preferences of its world clientele. These measures collectively underscore AximTrade’s dedication to offering a safe and dependable buying and selling atmosphere.

Professionals and Cons of AximTrade

Professionals

- Globally acknowledged and controlled

- $1 minimal for cent/normal accounts

- ECNs begin at $50

- Aggressive spreads and commissions

- Leverage as much as 1:Infinite

- Cryptocurrency and digital funds

- Social buying and selling for further revenue

- Free entry to MT4

Cons

- No entry for US, UK, Canada merchants

- Lacks internet terminal

Signal-Up Bonus of AximTrade

Within the ever-competitive world of foreign currency trading, brokers typically supply incentives to draw new shoppers. Nevertheless, as of the newest replace, AximTrade doesn’t supply a sign-up bonus. This resolution displays the dealer’s concentrate on different elements of their service, resembling aggressive buying and selling circumstances and entry to superior buying and selling platforms.

Minimal Deposit of AximTrade

When buying and selling, the minimal deposit is a vital issue for a lot of buyers, particularly these new to the market or with restricted capital. AximTrade stands out by providing a extremely accessible entry level. For cent and normal accounts, the minimal deposit begins at simply $1, making it a lovely possibility for newcomers or these wishing to check the dealer’s companies with minimal monetary dedication.

For merchants fascinated with extra specialised buying and selling circumstances, resembling tighter spreads and extra direct market entry, AximTrade provides ECN accounts with a minimal deposit ranging from $50. This tier is tailor-made for extra skilled merchants or these seeking to have interaction with bigger volumes. This stratification in deposit necessities ensures that AximTrade caters to a large spectrum of merchants, from novices to seasoned buyers, by offering versatile monetary entry factors.

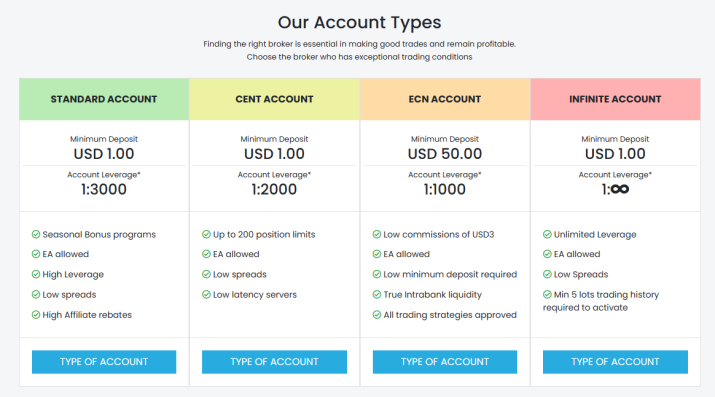

AximTrade Account Sorts

After thorough analysis and testing by our staff of specialists at Dumb Little Man, we’ve compiled an in depth overview of AximTrade‘s account varieties, designed to cater to each Foreign exchange newcomers {and professional} merchants. All accounts function assist for foreign money pair trades, damaging steadiness safety, and place hedging. Margin calls and Cease out ranges are set at 60%/30%, respectively.

Cent

- Micro account with a $1 minimal deposit.

- Contract measurement of 1,000 items.

- Leverage as much as 1:2,000.

- Spreads begin at 1 pip for main foreign money pairs.

- Indices and cryptocurrencies buying and selling unavailable.

Customary

- Fundamental account with floating spreads from 1 pip for main pairs.

- $1 minimal deposit.

- Trades currencies, cryptocurrencies, CFDs on indices, metals, and vitality with as much as 1:3,000 leverage.

ECN

- Skilled account with the tightest spreads from 0.0 pips on main foreign money pairs.

- $3 fee per lot every approach.

- Leverage as much as 1:100.

- $50 minimal deposit.

- Buying and selling property choice much like the usual account.

INFINITE

- Fundamental account with spreads as little as 3 Pip.

- Limitless leverage.

- $1 minimal deposit.

- Margin name/Cease out degree: 60% / 0%.

PRO

- Skilled account with spreads as little as 5 pips.

- Excessive minimal deposit of $300.

- Leverage as much as 1:1,000.

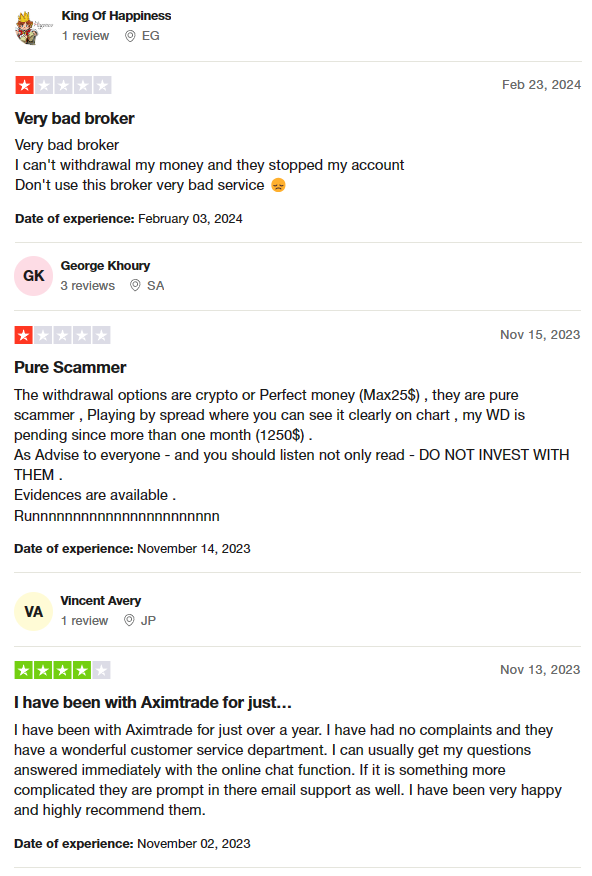

AximTrade Buyer Critiques

Buyer evaluations of AximTrade reveal a combined reception amongst its customers. Some clients have expressed important dissatisfaction, highlighting points with withdrawals and account administration. Complaints embrace difficulties in withdrawing funds, with choices restricted to cryptocurrency or Excellent Cash, and cases of accounts being unexpectedly frozen.

Accusations of the dealer being a “rip-off” attributable to problematic unfold practices and extended pending withdrawals have been voiced, urging potential shoppers to keep away from investing. Contrarily, one other section of customers experiences a optimistic expertise, praising the dealer’s customer support.

These clients spotlight an environment friendly on-line chat operate for instant question decision and commend the immediate e-mail assist for extra advanced points. This group of customers has really useful AximTrade, glad with over a yr of service. This divergence in suggestions means that whereas AximTrade might supply commendable buyer assist to some, it faces critical allegations of service inconsistencies and operational points from others, reflecting a broad spectrum of dealer experiences.

AximTrade Charges, Spreads, and Commissions

When navigating the monetary panorama of AximTrade, understanding its charges, spreads, and commissions is important for merchants. Notably, AximTrade doesn’t impose commissions on deposits and withdrawals, though fees from sure fee methods might apply. For example, Skrill and Neteller deduct a 4% price from the transaction quantity for withdrawals. Moreover, the dealer ensures that account upkeep comes with none price.

When it comes to buying and selling prices, AximTrade adopts a floating unfold mannequin. Spreads begin from 1 pip for each cent and normal accounts, providing aggressive charges for merchants. For these using ECN accounts, spreads will be as little as 0.0 pips, accompanied by a further fee of USD 3 per lot for the opening and shutting of positions. One other price to contemplate is the swap price, which is a fee charged for transferring a place to the subsequent buying and selling day.

These monetary constructions underscore AximTrade’s dedication to transparency and cost-efficiency in buying and selling operations. By offering a transparent breakdown of relevant charges and the circumstances beneath which they’re charged, AximTrade caters to a variety of merchants, from these searching for minimal preliminary investments to skilled merchants in search of superior buying and selling circumstances.

Deposit and Withdrawal

The deposit and withdrawal processes at AximTrade have been carefully examined and examined by a buying and selling skilled at Dumb Little Man, making certain an intensive analysis. The findings reveal that AximTrade processes all withdrawal requests inside 24 working hours, contingent upon the dealer’s verification standing. It’s noteworthy that funds are immediately credited via all accessible channels as soon as deposited.

For withdrawals, AximTrade helps a wide range of strategies tailor-made to its worldwide clientele. Neteller, Skrill, and USDT (ERC20) are universally accessible, whereas FasaPay is unique to Indonesian merchants. Financial institution transfers cater to shoppers from Malaysia, Indonesia, Thailand, Vietnam, China, and India. AximTrade can be within the strategy of increasing its withdrawal choices to incorporate Bitcoin, MomoPay, Zalopay, Visa, and Mastercard, enhancing accessibility for its customers.

Remarkably, AximTrade doesn’t impose a withdrawal price, though fee methods resembling Skrill and Neteller levy a 4% cost on the transaction quantity. For different methods, the price is 0%. The minimal withdrawal quantities differ by foreign money and methodology, making certain flexibility for merchants throughout totally different areas. This complete method to managing monetary transactions underscores AximTrade’s dedication to offering a seamless and environment friendly banking expertise for its customers.

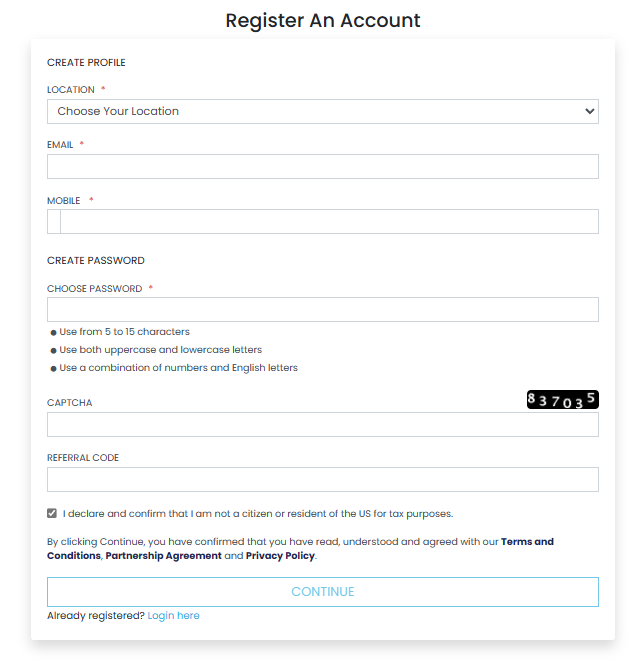

The way to Open an AximTrade Account

- Go to AximTrade’s web site and choose New Account on the appropriate aspect.

- Enter your nation of residence, e-mail tackle, and telephone quantity.

- Create a password to your account and enter a referral code if accessible.

- Affirm you’re not a US tax resident and submit the shape.

- Search for a registration affirmation in your display.

- Test your cell for an OTP code from AximTrade and enter it.

- Confirm your account via the affirmation hyperlink despatched to your e-mail.

- Navigate again to the essential web page of the AximTrade web site.

- Click on Member Login and enter your e-mail, password, and CAPTCHA code.

AximTrade Affiliate Program

The AximTrade Affiliate Program caters to each personal merchants and corporations, providing profitable alternatives to earn further revenue. Individuals can get pleasure from a most reward of as much as $20 per lot traded by their direct referrals, plus as much as 10% earnings from second-level referrals. This tiered system enhances the incomes potential for associates, making this system notably engaging.

Moreover, this system features a Loyalty Program, which rewards lively associates with the possibility to win priceless prizes resembling smartphones, watches, vehicles, and luxurious holidays. Eligibility for these attracts requires associates to attain a complete referral buying and selling quantity of 3,000 heaps inside a three-month interval, incentivizing each recruitment and buying and selling exercise amongst referred shoppers.

AximTrade helps its associates with every day remuneration, making certain constant and well timed rewards for his or her efforts. Moreover, this system boasts around-the-clock assist and assigns a private supervisor to every affiliate, addressing any queries or considerations that will come up. Importantly, there are no restrictions on withdrawals, permitting associates to entry their earnings freely and at any time when they select, highlighting AximTrade’s dedication to a clear and rewarding affiliate partnership.

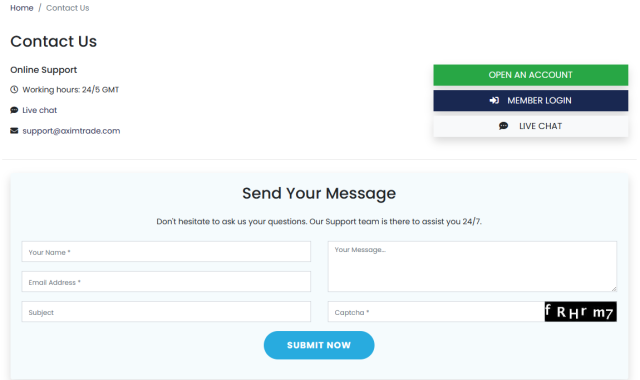

AximTrade Buyer Assist

Primarily based on the experiences of Dumb Little Man with AximTrade‘s Buyer Assist, it’s evident that the dealer prioritizes accessible and versatile communication channels for its shoppers. AximTrade provides a number of methods for merchants to succeed in out, together with dwell chat, a devoted kind for queries, e-mail at [email protected], and thru social media platforms like Instagram, Fb, Twitter, and LinkedIn. This multi-channel method ensures that shoppers can select probably the most handy methodology for them, enhancing the general assist expertise.

The provision of the on-line chat function is especially noteworthy, because it extends past the web site to incorporate the consumer’s private account space. This ensures that help is available at each stage of the consumer’s journey with AximTrade, from normal inquiries on the web site to particular questions throughout the buying and selling atmosphere. This degree of assist accessibility underscores AximTrade’s dedication to offering a supportive and responsive service to its shoppers, thereby enhancing dealer satisfaction and confidence within the platform.

Benefits and Disadvantages of AximTrade Buyer Assist

AximTrade vs Different Brokers

#1. AximTrade vs AvaTrade

AximTrade, identified for its low entry threshold and excessive leverage choices, caters particularly effectively to merchants searching for flexibility in buying and selling circumstances. Its capacity to supply infinite leverage and a $1 minimal deposit for sure account varieties stands in distinction to AvaTrade‘s method, which emphasizes a broad vary of economic devices and a powerful regulatory framework throughout a number of jurisdictions. With over 300,000 registered clients and a concentrate on offering a full on-line buying and selling expertise, AvaTrade appeals to merchants in search of a diversified portfolio and stringent regulatory safety.

Verdict: AvaTrade could be higher for merchants valuing a big selection of economic devices and regulatory safety. In distinction, AximTrade is extra suited to these prioritizing versatile buying and selling circumstances and excessive leverage.

#2. AximTrade vs RoboForex

RoboForex provides a powerful array of over 12,000 buying and selling choices throughout eight asset courses, supported by a wide range of buying and selling platforms like MetaTrader, cTrader, and RTrader. Its robust emphasis on cutting-edge know-how and tailor-made buying and selling circumstances makes it a powerful competitor. AximTrade, with its concentrate on excessive leverage and low minimal deposits, supplies a simple entry level for brand new and skilled merchants alike however would possibly lack the breadth of buying and selling choices and platform selection that RoboForex boasts.

Verdict: RoboForex edges out for merchants who worth range in buying and selling platforms and a wide selection of buying and selling devices. Nevertheless, for these in search of simplicity and excessive leverage, AximTrade stays a compelling selection.

#3. AximTrade vs FXChoice

FXChoice, with its dedication to serving each lively and passive merchants since 2010, emphasizes high quality brokerage companies and a collection of buying and selling devices and companies for automated buying and selling. The main focus right here is on skilled merchants, given the absence of cent accounts, zero spreads, and the restricted validity of demo accounts. In distinction, AximTrade appeals to a broader viewers with its low minimal deposits and excessive leverage choices, providing a extra accessible entry level for newcomers and suppleness for seasoned merchants.

Verdict: For knowledgeable merchants targeted on automated buying and selling {and professional} ECN accounts, FXChoice would be the preferable possibility, given its tailor-made companies and strict regulatory atmosphere. AximTrade, nonetheless, provides broader attraction to these new to foreign currency trading or these searching for excessive leverage and low entry obstacles.

Select Asia Foreign exchange Mentor for Your Foreign exchange Buying and selling Success

For people obsessed with forging a profitable profession in foreign currency trading and aiming for important monetary success, Asia Foreign exchange Mentor is the prime vacation spot for top-notch foreign exchange, inventory, and crypto buying and selling training. The founder, Ezekiel Chew, a celebrated determine amongst buying and selling establishments and banks, is the cornerstone of Asia Foreign exchange Mentor. Notably, Ezekiel’s common seven-figure trades set him a lower above different educators, showcasing his distinctive prowess within the discipline. The explanations for our endorsement are compelling:

Complete Curriculum: Asia Foreign exchange Mentor delivers an intensive instructional package deal spanning inventory, crypto, and foreign currency trading. The curriculum is meticulously designed to arm budding merchants with the requisite expertise and data to thrive in these assorted markets.

Confirmed Monitor Document: The popularity of Asia Foreign exchange Mentor is solidified by its observe document of constantly grooming worthwhile merchants in several market segments. This success underscores the efficacy of their instructional methods and mentorship.

Skilled Mentor: Learners at Asia Foreign exchange Mentor profit from the experience of a mentor with a confirmed observe document in inventory, crypto, and foreign currency trading. Ezekiel provides personalised help, guiding college students via the complexities of every market confidently.

Supportive Neighborhood: Enrolling in Asia Foreign exchange Mentor grants entry to a welcoming group of formidable merchants targeted on success within the inventory, crypto, and foreign exchange arenas. This atmosphere encourages mutual assist, trade of concepts, and collaborative studying, enriching the tutorial journey.

Emphasis on Self-discipline and Psychology: Mastery in buying and selling requires a disciplined mindset and psychological resilience. Asia Foreign exchange Mentor emphasizes psychological coaching to assist merchants in managing feelings, dealing with stress, and making knowledgeable choices throughout buying and selling actions.

Fixed Updates and Sources: Given the ever-changing nature of economic markets, Asia Foreign exchange Mentor ensures learners keep knowledgeable on the newest traits, methods, and market insights. Ongoing entry to important sources positions merchants to remain aggressive.

Success Tales: Asia Foreign exchange Mentor is pleased with its quite a few success tales, with many college students considerably remodeling their buying and selling endeavors and attaining monetary autonomy via its intensive training in foreign exchange, inventory, and crypto buying and selling.

Asia Foreign exchange Mentor stands out because the foremost possibility for these wanting the best foreign exchange, inventory, and crypto buying and selling training, aiming to domesticate a worthwhile profession and attain monetary progress. With its all-inclusive curriculum, expert mentors, sensible studying method, and supportive group, Asia Foreign exchange Mentor equips aspiring merchants with the instruments and mentorship essential to turn into profitable professionals in varied monetary markets.

Conclusion: AximTrade Overview

In conclusion, the staff of buying and selling specialists at Dumb Little Man has supplied a complete assessment of AximTrade, highlighting its strengths and areas of concern. AximTrade emerges as a formidable participant within the foreign exchange brokerage trade, celebrated for its low entry obstacles and excessive leverage choices. These options make it notably interesting to new merchants and people seeking to maximize their buying and selling potential with minimal preliminary funding.

Nevertheless, it’s essential for potential customers to weigh the dealer’s benefits in opposition to its shortcomings. Whereas AximTrade provides aggressive spreads and a variety of account varieties to go well with varied buying and selling kinds, considerations relating to buyer assist limitations and regional restrictions shouldn’t be missed. The absence of a sign-up bonus may additionally deter some merchants, accustomed to such incentives from different brokers.

>> Additionally Learn: NAGA Overview 2024 with Rankings By Dumb Little Man

AximTrade Overview FAQs

What minimal deposit is required to start out buying and selling with AximTrade?

To start buying and selling with AximTrade, the minimal deposit requirement varies relying on the account sort chosen. For cent and normal accounts, a minimal deposit of $1 is required, making it extremely accessible for newcomers. For these fascinated with ECN accounts, which provide tighter spreads and extra direct market entry, the minimal deposit begins from $50. This flexibility ensures that merchants of all ranges can discover an account that fits their monetary capability and buying and selling technique.

Does AximTrade supply a sign-up bonus for brand new merchants?

As of the newest info accessible, AximTrade doesn’t supply a sign-up bonus for brand new merchants. The main focus of AximTrade is extra on offering aggressive buying and selling circumstances, resembling low entry necessities and excessive leverage, somewhat than upfront monetary incentives. Merchants in search of value-added options would possibly discover the dealer’s aggressive spreads and leverage choices to be compelling causes to hitch, even within the absence of a sign-up bonus.

How does AximTrade guarantee the protection and safety of dealer funds?

AximTrade prioritizes the protection and safety of its merchants’ funds via a number of mechanisms. Firstly, it operates beneath the regulation of respected our bodies such because the ASIC and SVGFSA, making certain compliance with strict monetary requirements. Moreover, AximTrade employs the follow of segregating consumer funds from firm funds, which implies that merchants’ cash is stored in separate financial institution accounts. This segregation helps defend shoppers’ funds within the unlikely occasion of economic instability or insolvency of the dealer. Moreover, AximTrade supplies damaging steadiness safety, safeguarding merchants from dropping greater than their account steadiness throughout risky market circumstances.