BoJ Price Hike to 0.25%

The Financial institution of Japan (BoJ) voted 7-2 to extend the coverage charge from 0.1% to 0.25%. This marks a step towards normalizing financial coverage because the BoJ outlines particular figures for its bond purchases, transferring away from the in depth stimulus measures.

Bond Tapering Schedule

The BoJ introduced it’ll lower Japanese authorities bond (JGB) purchases by ¥400 billion every quarter. Month-to-month JGB purchases might be decreased to ¥3 trillion from January to March 2026.

The BoJ indicated that if financial exercise and costs align with their outlook, additional charge hikes and changes to financial lodging will comply with.

Decreasing lodging is seen as important for attaining the 2% value goal sustainably. Regardless of this, the BoJ famous the necessity to keep an accommodative atmosphere resulting from adverse actual rates of interest supporting financial exercise.

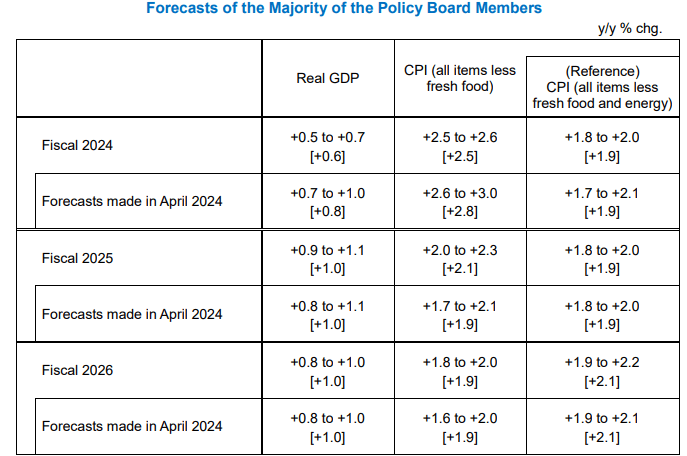

The quarterly outlook means that costs and wages will keep elevated, with personal consumption anticipated to rise reasonably regardless of increased costs.

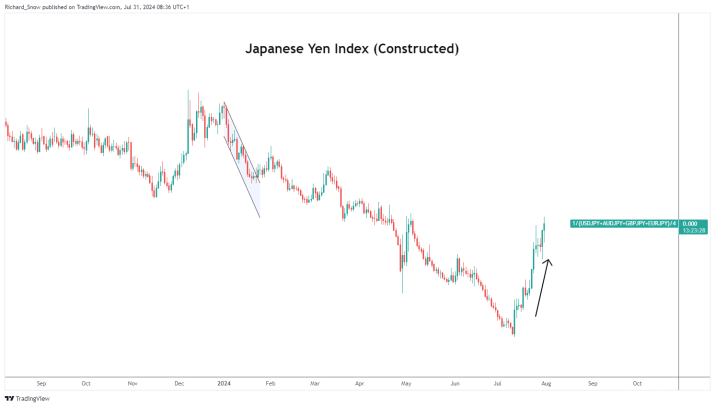

Yen Strengthens Publish-Hawkish BoJ Assembly

The Japanese Yen skilled preliminary volatility however strengthened after the BoJ’s hawkish measures had been digested by the market. This appreciation comes because the US economic system moderates and the BoJ observes a optimistic relationship between wages and costs, resulting in decreased financial lodging. Hypothesis round FX intervention from Tokyo officers adopted the yen’s sharp appreciation publish decrease US CPI knowledge.

A key takeaway from the BoJ assembly is the affect of FX markets on inflation. Beforehand, BoJ Governor Kazuo Ueda acknowledged the weaker yen had minimal impact on rising costs. This time, nonetheless, Ueda cited the weaker yen as a motive for the speed hike.

There’s now a better deal with the USD/JPY degree, with a bearish development anticipated if the Fed lowers the Fed funds charge this night. The 152.00 degree is important, marking final 12 months’s excessive earlier than FX intervention brought on a pointy drop in USD/JPY.

The RSI has quickly shifted from overbought to oversold, indicating elevated volatility. Japanese officers are hoping for a dovish Fed choice, which might decrease the Fed funds charge, making 150.00 the subsequent key assist degree.

The publish BoJ Raises Charges to 0.25%, Plans Bond Tapering appeared first on Dumb Little Man.