British Pound (GBP/USD) Market Evaluation

GBP/USD has modestly declined however stays above $1.25. With UK and US rates of interest anticipated to lower beginning in September, the highlight is now on the upcoming Financial institution of England (BoE) announcement.

On Tuesday, the British Pound pared a few of its latest beneficial properties towards the U.S. Greenback as markets regained full exercise following a vacation. As we strategy Thursday’s BoE financial coverage assembly for Could, Sterling’s cross charges will doubtless see slight actions.

Rates of interest are projected to stay regular this month, with the central Financial institution Fee anticipated to carry at 5.25%. Market consideration will thus pivot to the voting dynamics inside the nine-member Financial Coverage Committee and the nuances of their accompanying statements. Traditionally, the BoE has proven different voting outcomes, together with three-way splits. This time, nevertheless, a cut up favoring hikes is unlikely.

Inflation within the UK continues to exceed the BoE’s 2% goal however reveals indicators of easing, with the most recent March determine at 3.2%—the bottom in over two years. This means that the prevailing financial tightening is steadily taking impact, even because the UK economic system struggles with sluggish development.

Futures markets presently predict that each the UK and the US may provoke fee cuts as quickly as September, a forecast closely reliant on upcoming financial knowledge. Final week’s tepid US employment figures have introduced ahead the expectations for the Federal Reserve’s actions, beforehand anticipated in November.

Sterling is anticipated to hover inside its present buying and selling vary main as much as the BoE’s resolution and may face challenges in appreciating if the rate-cut expectations stay unchanged.

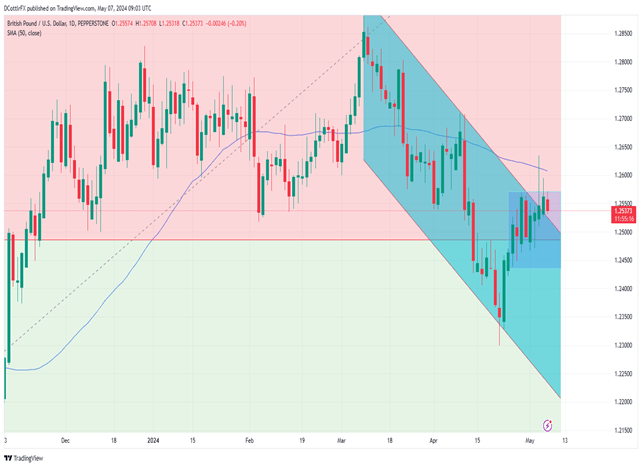

Regardless of just lately edging above the longstanding downtrend that began in mid-March, Sterling’s rise doesn’t seem completely convincing. Bulls nonetheless have vital floor to cowl to safe a extra definitive upward development.

At present, the buying and selling vary is ready between April 29’s excessive of 1.25692 and April 24’s low of 1.24201, with the downtrend offering close to help at 1.25178.

Help at 1.24859 stays sturdy, and the 50-day shifting common at 1.26067 may act as resistance if the higher vary restrict is breached.

All through this 12 months, the pair has largely remained above the primary retracement stage from its rise to final July’s peaks from the lows of September 2022. It’s prone to keep above this stage barring any vital shifts available in the market.

The put up British Pound Dips as Focus Turns to Financial institution of England appeared first on Dumb Little Man.