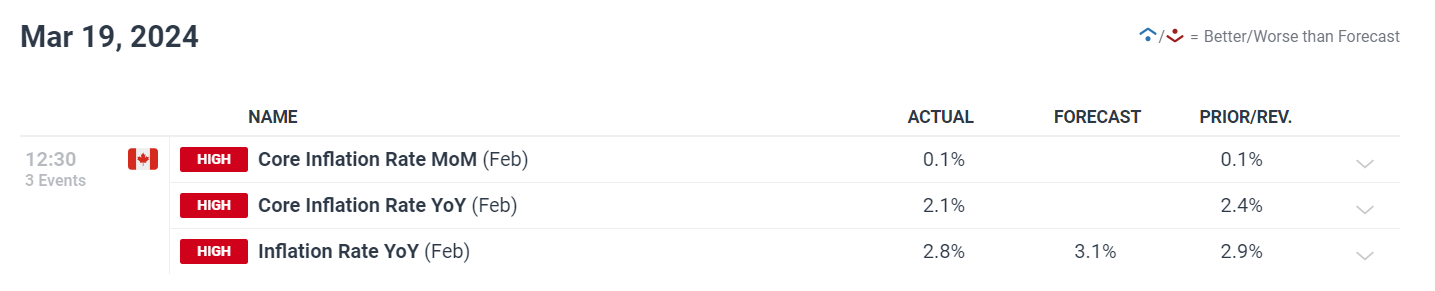

Canada’s February inflation, together with each core and headline measures, slowed greater than anticipated, with the CPI dropping effectively beneath the 3.1% estimate to 2.8%.

With this decline, core inflation has reached its lowest degree in additional than two years, rising strain on the Financial institution of Canada (BoC) to ponder easing monetary circumstances.

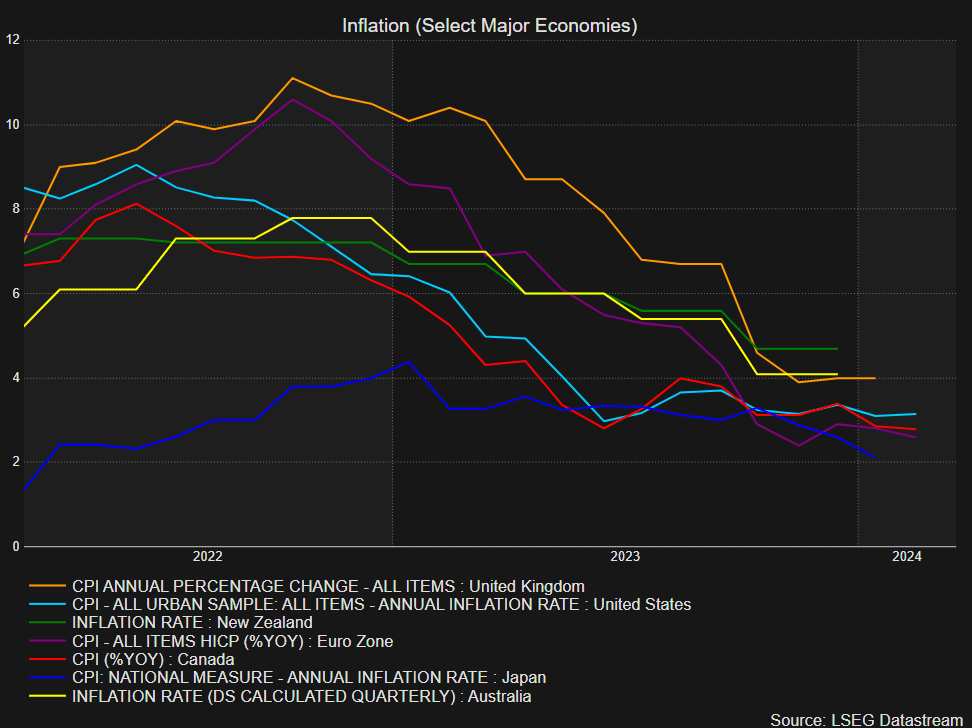

When in comparison with different nations with inflation charges of greater than 8%, Canada stands out because of this growth, which is illustrated within the graph beneath.

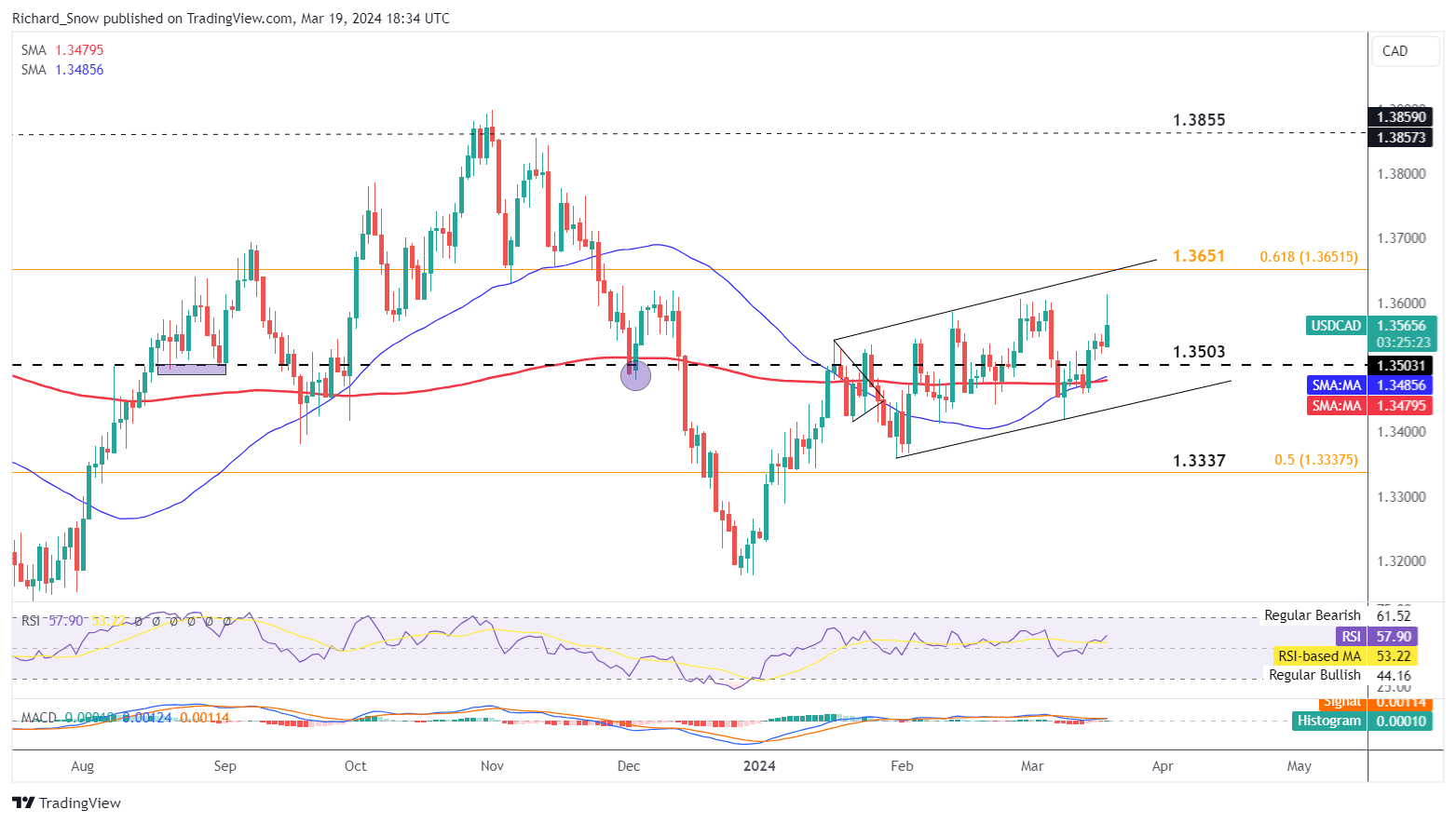

USD/CAD’s Blended Response Amid Inflation Information

The USD/CAD pair rose sharply after the discharge of the softer inflation information, however it misplaced momentum because the New York session went on. The pair’s bullish trajectory targets channel resistance, bouncing off a assist bounce at 1.3420 and breaking above the 200-day SMA at 1.3500.

This resistance is predicted to align with the principle 2020–2022 motion’s 61.8% Fibonacci retracement. Nonetheless, the huge higher wick formation means that bulls might have to regroup.

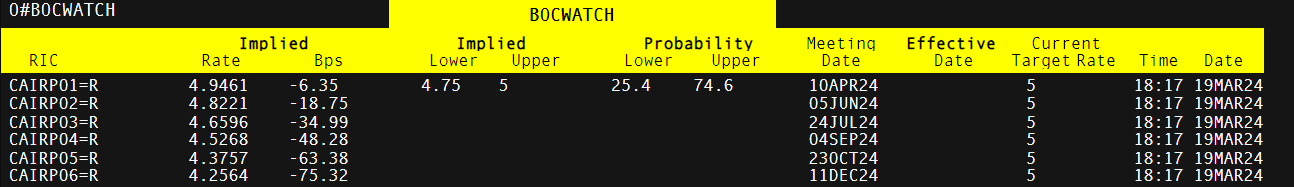

Market Reactions and Charge Lower Projections

Buyers are actually extra closely betting on a BoC charge lower in June, with market probabilities supporting a lower at roughly 62%, because of the sudden slowdown in Canada’s inflation. To reduce financial strain, the rationale for easing financial coverage is strengthened by the continuing decreased inflation.

However, expectations for the Federal Reserve to chop rates of interest have shifted from June to July, probably sustaining a favorable rate of interest differential for the USD in opposition to G7 currencies.Core inflation metrics in Canada additionally fell to ranges not seen in additional than two years, though headline inflation dipped at a charge that was the slowest since final June.

Such information has ramped up investor bets for a June charge lower, with cash market predictions for a 25 foundation level discount exceeding 75%. Charge cuts starting in June are actually anticipated to be set in movement by the BoC’s extra dovish outlook in April.

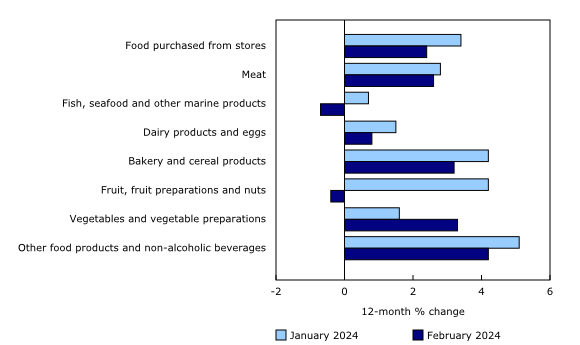

The Canadian foreign money fell to a three-month low versus the US greenback because of the inflation deceleration, and the yield on the nation’s 10-year bond considerably decreased. Decrease meals costs in addition to cheaper web and cell service contributed to the general slowdown in inflation for Canadians.

Last Ideas

Analysts argue that the present inflation information justifies a June charge lower. They warn that any additional delays may damage the financial system. With the BoC sustaining charges to fight inflation, the most recent figures recommend a potential shift in coverage may very well be imminent.

Nonetheless, the financial institution has indicated it seeks sustained proof of underlying inflation slowing earlier than contemplating charge reductions. Because the BoC prepares to replace its forecasts, the main target stays on attaining a cautious stability between stimulating financial development and sustaining value stability.

The submit Canada’s February Inflation Slowdown Fuels June Charge Lower Expectations Amidst Fed’s Delayed Cuts appeared first on Dumb Little Man.