Market Outlook and Sentiment Evaluation

Within the dynamic realm of foreign money buying and selling, adopting contrarian methods can unveil hidden prospects by deviating from typical considering.

IG consumer sentiment gives helpful insights into the market’s sentiment, particularly when analyzing the Euro FX pairs equivalent to EUR/USD, EUR/CHF, EUR/GBP, and EUR/JPY.

When mixed with technical and basic evaluation, these insights supply merchants an intensive understanding of the market.

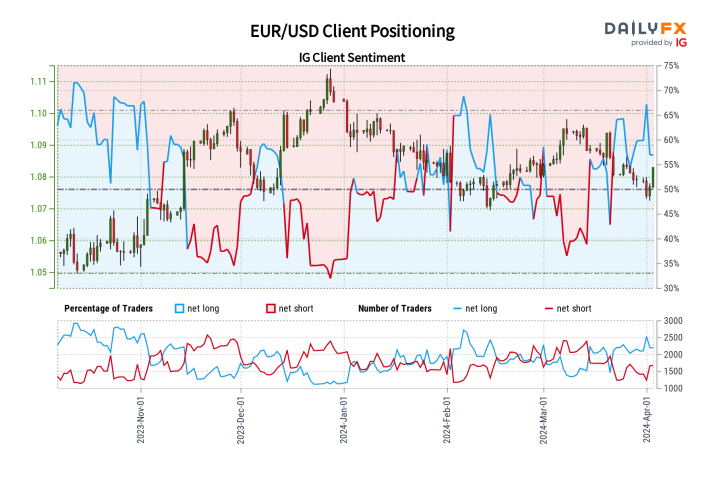

EUR/USD: A Combined Sentiment Panorama

The sentiment surrounding the EUR/USD pair is sort of nuanced, as most retail merchants appear to have a barely bullish leaning.

However, a notable enhance in bearish sentiment signifies the opportunity of a constructive shift. Merchants ought to train warning and take into account each sentiment and broader market analyses.

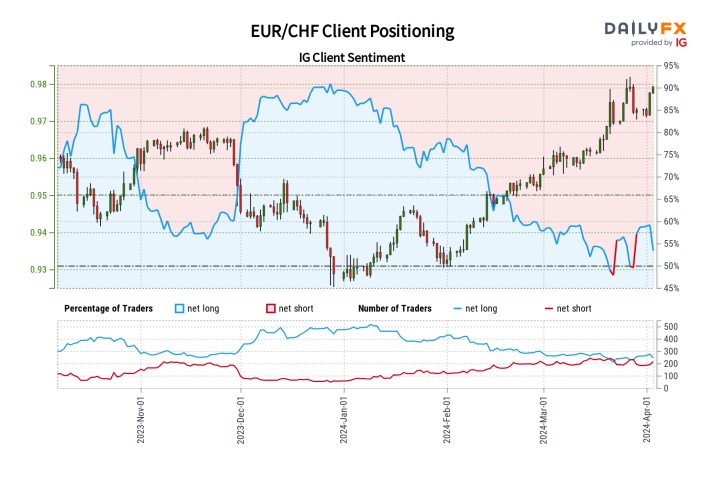

EUR/CHF: Bullish however Waning

Merchants are at the moment expressing a constructive outlook for EUR/CHF, though there are indications of a potential decline. There are conflicting indicators and a decline in optimistic positions that recommend the opportunity of downward corrections.

The future actions of this pair require a cautious strategy, highlighting the importance of a complete evaluation technique.

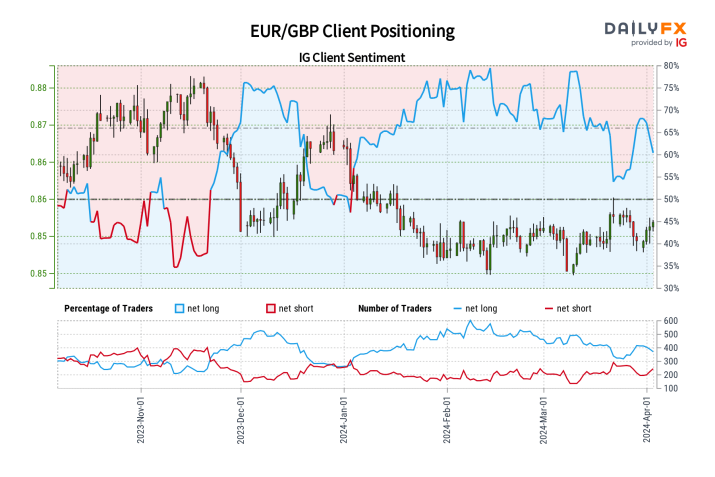

EUR/GBP: Optimism Faces Resistance

The EUR/GBP pair is at the moment experiencing a sturdy bullish sentiment, though latest adjustments point out a extra balanced market dynamic.

Contemplating the present market circumstances, it is very important stay cautious and make use of a balanced strategy that mixes each sentiment and technical evaluation.

Though there are some predictions of a potential decline from contrarian views, the total long-term pattern stays unsure, emphasizing the necessity for cautious statement and evaluation.

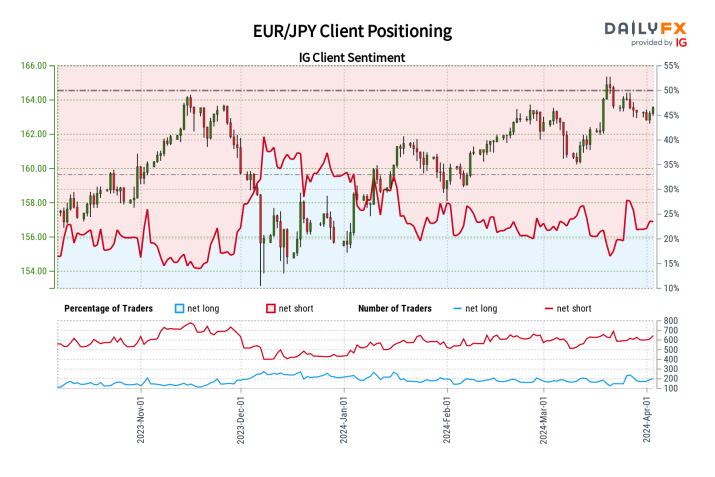

EUR/JPY: Bearish Bias with a Silver Lining

The EUR/JPY panorama is at the moment dominated by a sturdy bearish sentiment. Nonetheless, the rise in lengthy positions mixed with a bearish weakening suggests the opportunity of upward corrections.

You will need to intently observe adjustments in sentiment and correlate them with technical indicators.

Technical Insights: EUR/USD and EUR/CHF

The EUR/USD is nearing essential help ranges, suggesting potential adjustments in value shortly. Merchants ought to intently monitor any reactions occurring across the 1.0704/12 space. A potential breakdown on this area may point out the opportunity of further declines.

There’s a stage of resistance close to the 52-week transferring common, and whether it is damaged, it may point out a potential upward pattern.

The EUR/CHF pair continues to indicate power because it stays inside an upward channel, even within the face of occasional bearish corrections.

Key financial indicators, such because the EU unemployment fee and inflation information, supply helpful insights into the foreign money pair, shedding gentle on the uncertainties at play.

Conclusion

The present state of the Euro FX market is characterised by a multitude of things that affect each investor sentiment and technical indicators.

Merchants are suggested to undertake a market analyst mindset, incorporating contrarian views and counting on thorough technical and basic analyses to make knowledgeable selections.

Staying adaptable and well-informed would be the key to navigating the ever-changing market in these unsure occasions.