German Economic system Shrinks in Q2

The German economic system contracted within the second quarter, opposite to expectations of a minor growth. Preliminary knowledge from Destatis confirmed the economic system shrinking by 0.1% in Q2, in comparison with forecasts of 0.1% development and 0.2% development in Q1. In accordance with the Federal Statistical Workplace (Destatis), ‘investments in gear and buildings, adjusted for value, seasonal and calendar results, significantly decreased.‘ Revisions to the GDP knowledge will likely be introduced on August twenty seventh.

Later right this moment, the most recent German inflation figures will likely be carefully watched for any indicators of weakening value pressures. Monetary markets at present point out a 66% likelihood of a charge reduce on September 12, and any additional decline in German inflation will improve these odds. Preliminary German inflation knowledge is scheduled for launch at 13:00 UK time.

EUR/USD Evaluation

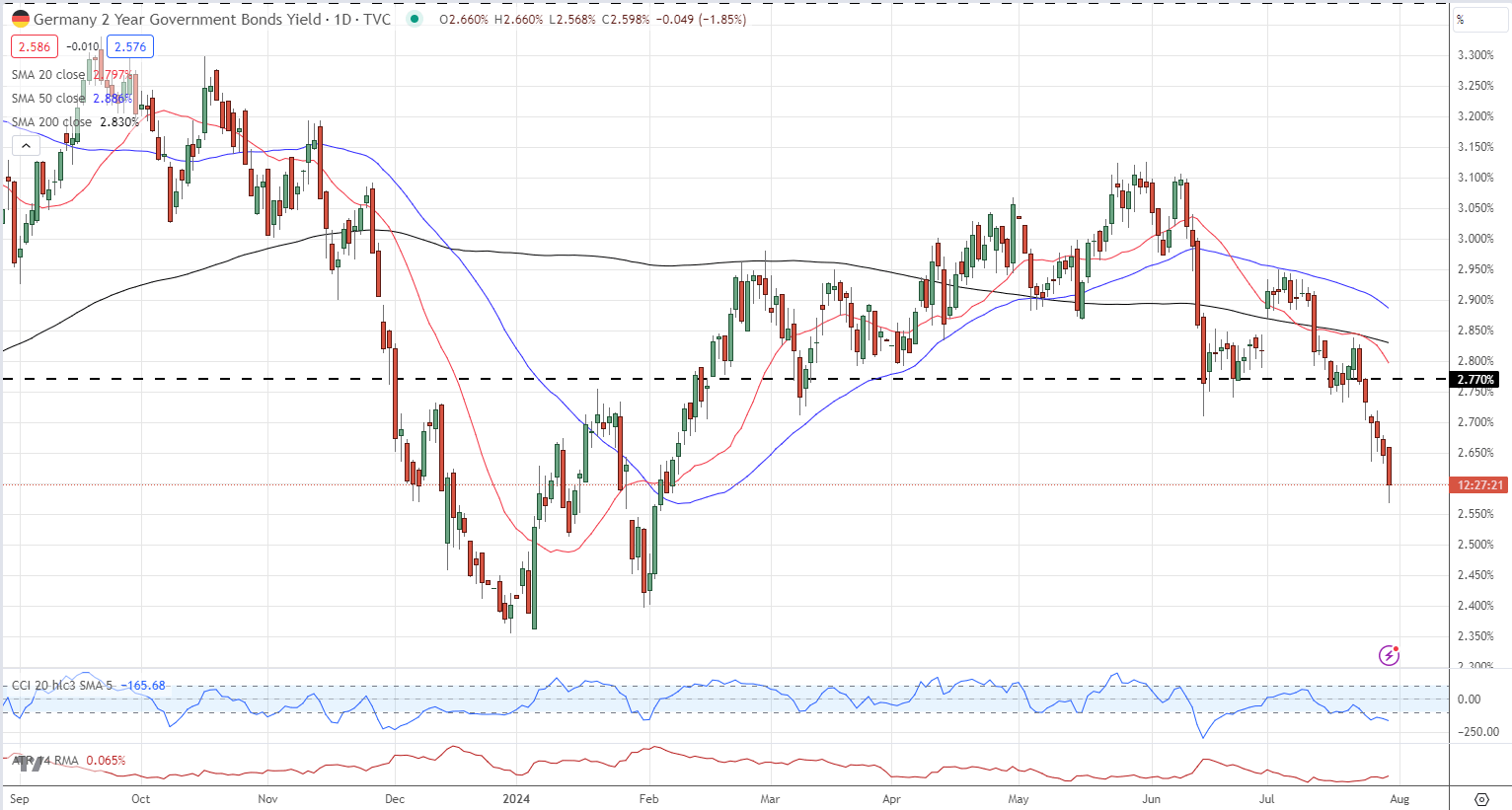

The EUR/USD pair is trying to get better a few of Monday’s losses, however the newest German GDP report is exerting renewed downward stress. Quick-dated German bond yields have returned to lows final seen in early February, additional weighing on the Euro.

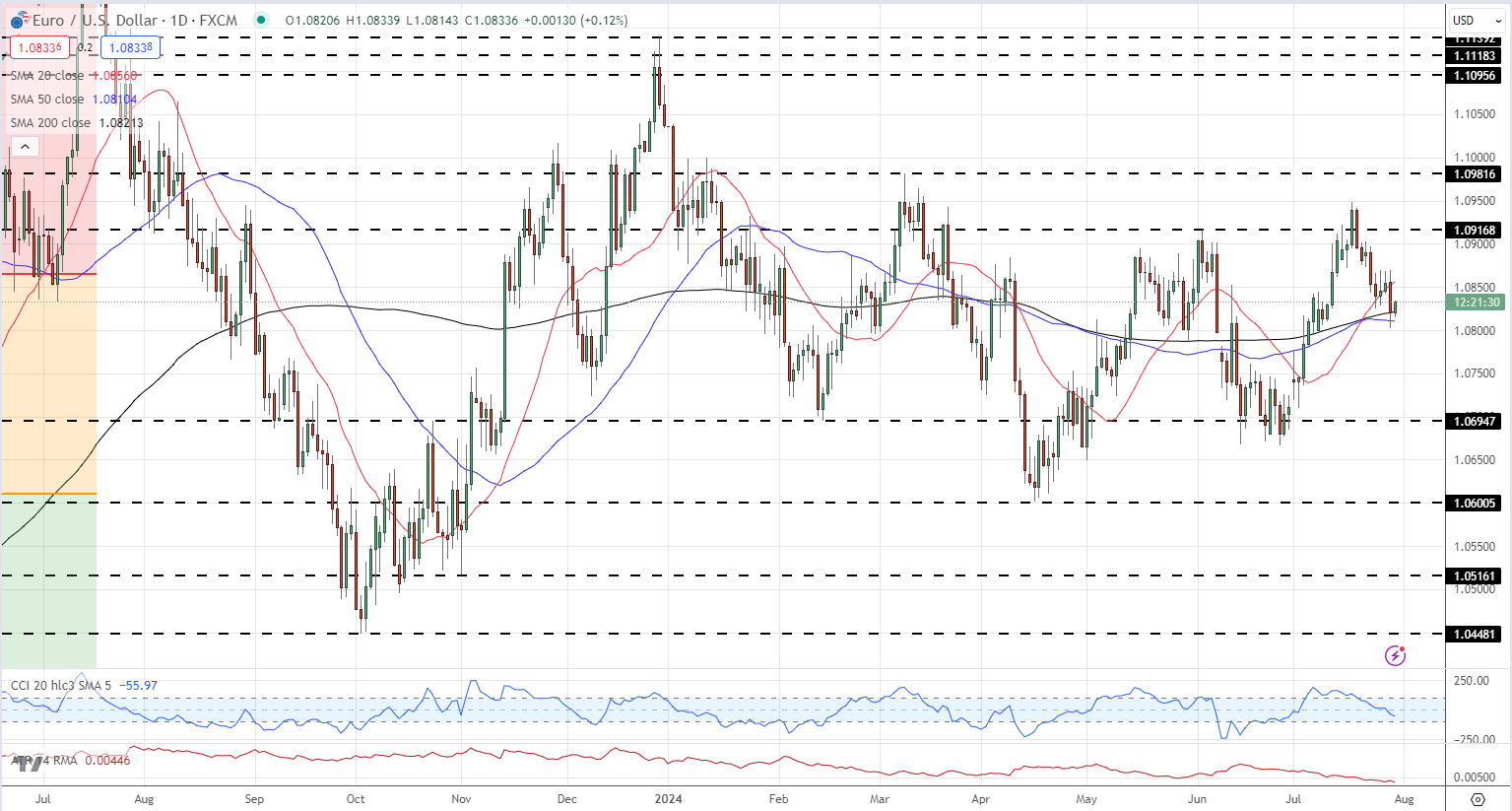

EUR/USD is at present buying and selling round 1.0830, beneath the 20-day SMA and simply above the 50- and 200-day SMAs. A break beneath the SMAs and Monday’s 1.0803 low might go away the pair weak to a transfer in the direction of the 1.0750 space earlier than 1.0700 turns into related. On the upside, EUR/USD would face resistance round current highs and the 23.6% Fibonacci retracement degree at 1.0866.

Retail Dealer Sentiment

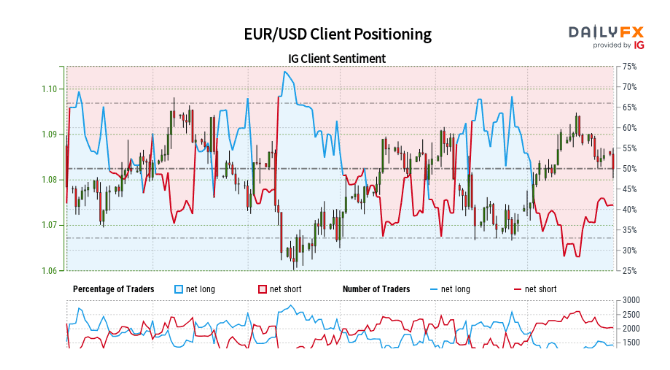

Retail dealer knowledge reveals 47.20% of merchants are net-long, with the ratio of merchants brief to lengthy at 1.12 to 1. The variety of merchants net-long is 14.81% increased than yesterday and 15.95% increased from final week, whereas the variety of merchants net-short is 9.23% decrease than yesterday and 23.48% decrease from final week.

Analysts typically take a contrarian view to crowd sentiment, and the truth that merchants are net-short suggests EUR/USD costs could proceed to rise. Nonetheless, merchants are much less net-short than yesterday and in contrast with final week. Latest adjustments in sentiment point out that the present EUR/USD value pattern could quickly reverse decrease regardless of the merchants remaining net-short.

The publish EUR/USD Falls as German Economic system Contracts appeared first on Dumb Little Man.