ECB’s Charge Reduce Technique and SNB’s Shock Resolution

Regardless of the stark distinction in financial development projections between the EU and the US, with the EU grappling with slower development, ECB officers are contemplating rate of interest cuts, eyeing June for the primary discount.

This transfer is propelled by growing wage development pressures and dwindling causes to delay easing financial coverage.

In an surprising maneuver, the Swiss Nationwide Financial institution (SNB) introduced a 25 foundation level minimize, searching for to normalize financial coverage amidst difficult exterior circumstances and anticipated sub-two % inflation, anticipated to persist by means of 2025 and into 2026.

Greenback Dynamics and EUR/USD Resistance

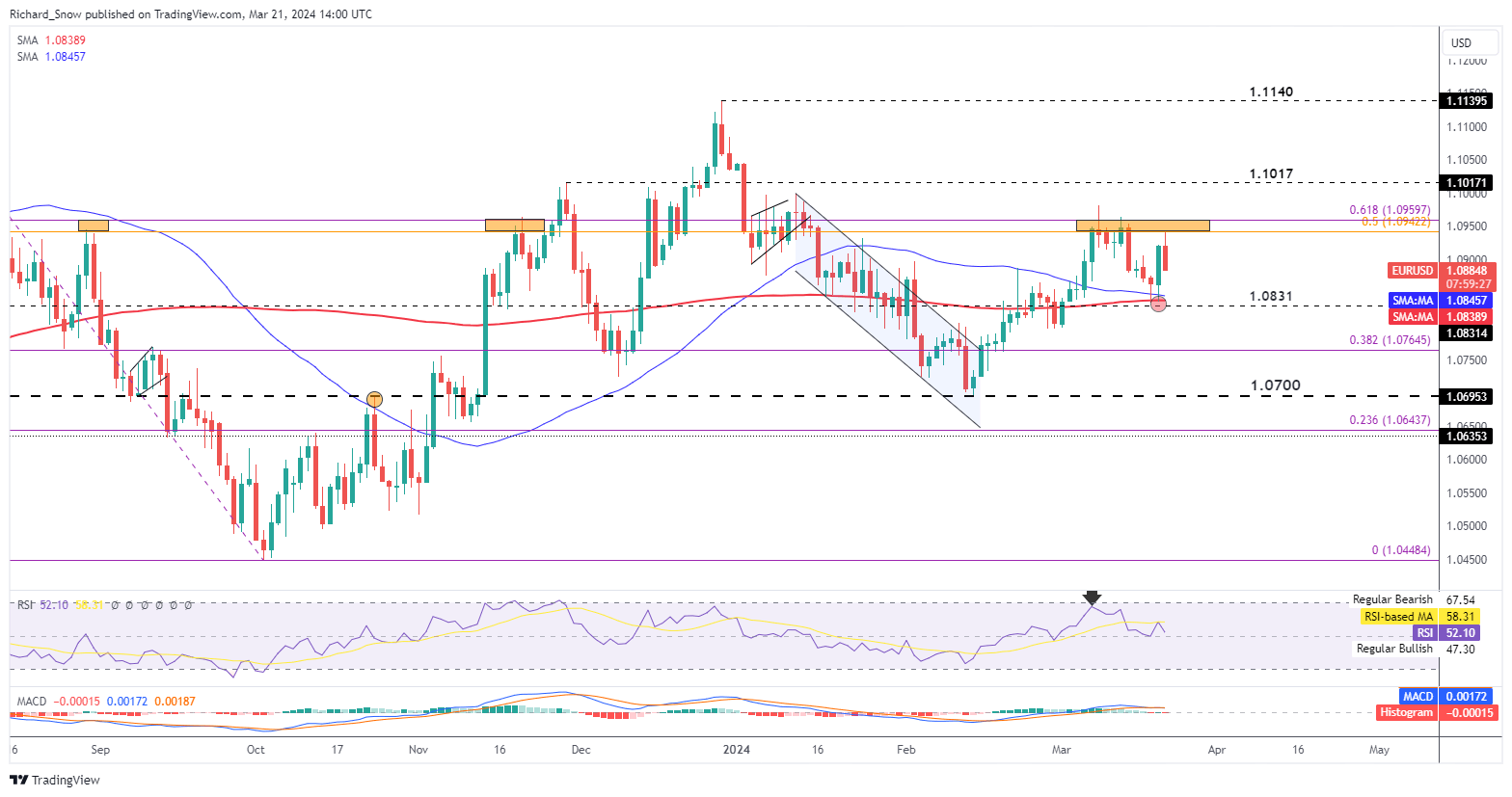

The US greenback skilled a transient decline after the Fed’s dovish stance, which unintentionally helped the EUR/USD pair rise.

The pair of currencies challenged resistance ranges round 1.0942 and 1.0960, however they’re nonetheless supported by necessary technical indicators, indicating a cautiously optimistic outlook for EUR/USD even within the face of anticipated stress from larger rates of interest and financial resilience to push the US greenback larger.

Financial Projections and Inflation Trajectories

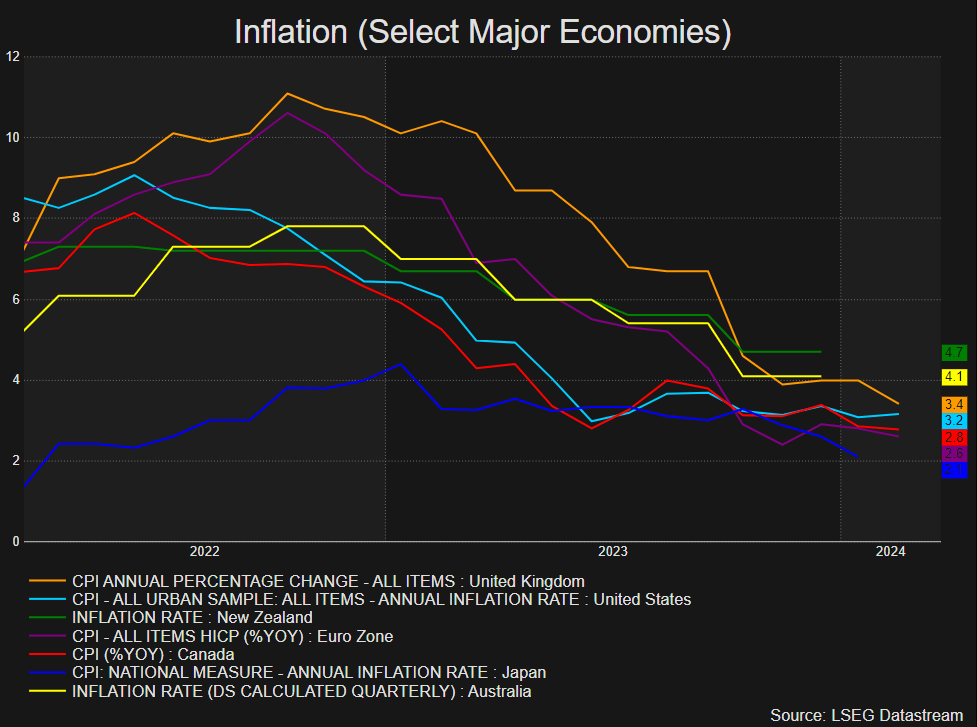

The Fed’s up to date financial projections trace at a doable hike within the impartial charge, indicative of enduring development and a sturdy labor market. Conversely, the European economic system’s stagnation would possibly immediate the ECB to decrease charges, particularly if inflation traits in the direction of the 2% goal.

The inflation trajectory in main economies is bettering, notably within the EU, the place the HICP shows a pattern towards decreased inflation charges, however ongoing worries.

Market Reactions to Financial Information and PMI Reviews

EUR/USD’s dynamics have been influenced by numerous financial indicators, together with disappointing PMI information from the EU and optimistic employment and manufacturing reviews from the US.

These developments spotlight the continuing financial contraction in Europe, in stark distinction to extra optimistic forecasts for the US.

Brief-term Technical Outlook for EUR/USD

Technically, EUR/USD is buying and selling between crucial help and resistance ranges, with the every day chart indicating that it stays above all of its transferring averages.

Nevertheless, technical indicators have begun to shift south inside bullish ranges, indicating that buying enthusiasm should still be reluctant. Key help is anticipated at 1.0865, the 38.2% Fibonacci retracement of the current surge, whereas resistance is seen close to 1.0920 and 1.0970.

Ultimate Ideas

Because the market digests the current selections by the ECB and SNB, alongside fluctuating financial information and sentiment, the near-term uplift for EUR/USD appears jeopardized.

The advanced interaction between rate of interest differentials, financial development outlooks, and inflation targets will stay pivotal in guiding forex market traits.

Merchants ought to keep alert, weaving these developments into their strategic planning amidst a backdrop of unsure market circumstances.

The submit EUR/USD Outlook: Publish-FOMC and SNB Developments Pose Menace to Current Features Amid Rising Optimism appeared first on Dumb Little Man.