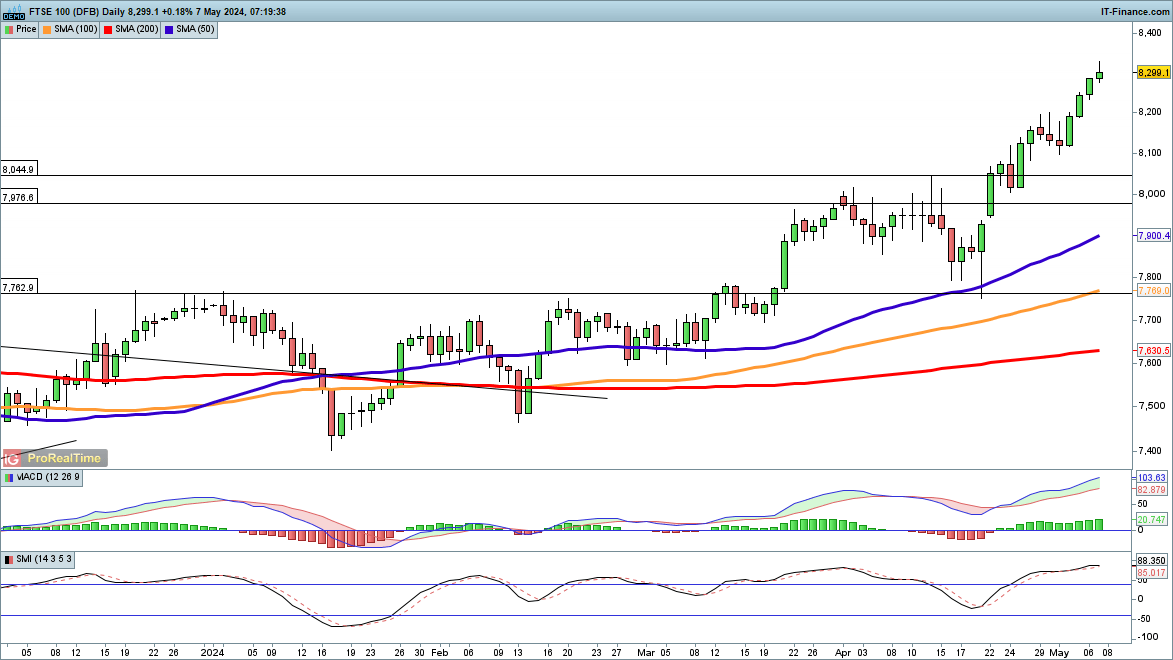

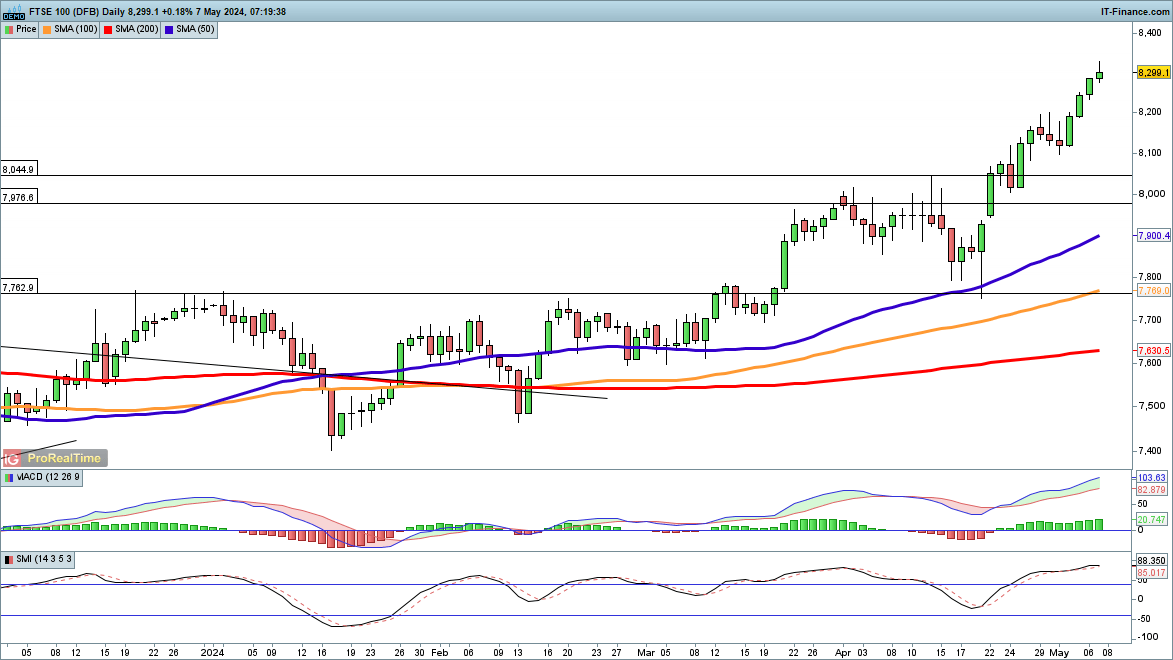

FTSE 100 Every day Overview

The FTSE 100 index has been on an glorious upward pattern, posting important positive aspects and reaching new information. Final week, the index outperformed expectations by breaking the 8,300 barrier and reaching a new excessive of 8,335.68.

That is the eleventh advance within the final 14 classes, with the market closing 1.2% larger. Nevertheless, the index is presently extremely overextended, about 5% above the 50-day SMA, which might point out a near-term decline. A drop beneath 8,100 might sign the start of a pullback.

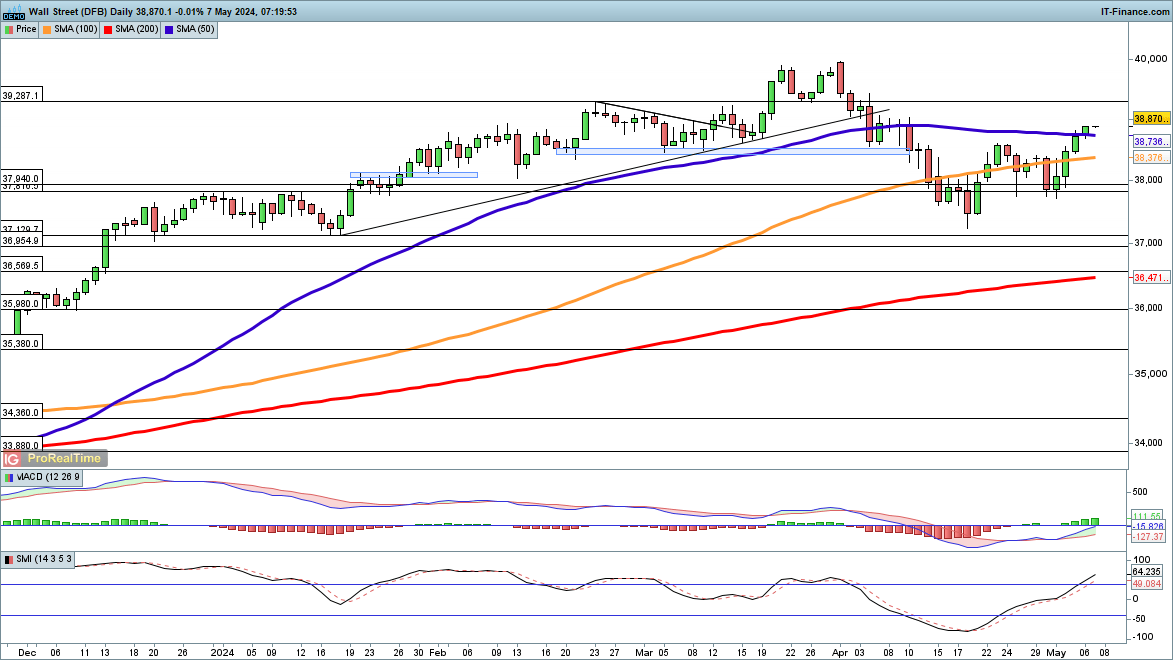

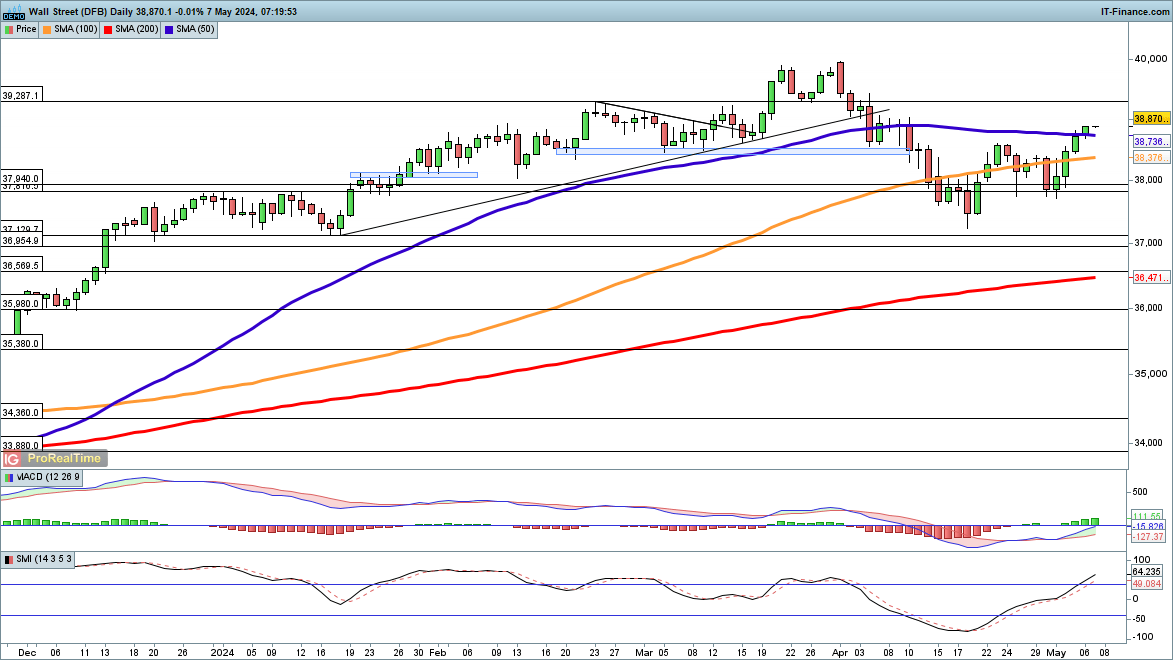

Dow Jones Industrial Common Insights

The Dow Jones Industrial Common is making a robust restoration, opening above the 50-day SMA for the primary time since April 4. Since its three-month low in mid-April, the index has risen round 1,500 factors, with the latest shut above 38,600 signaling further upward momentum.

The subsequent targets are 39,287 and presumably a new file round 40,000.

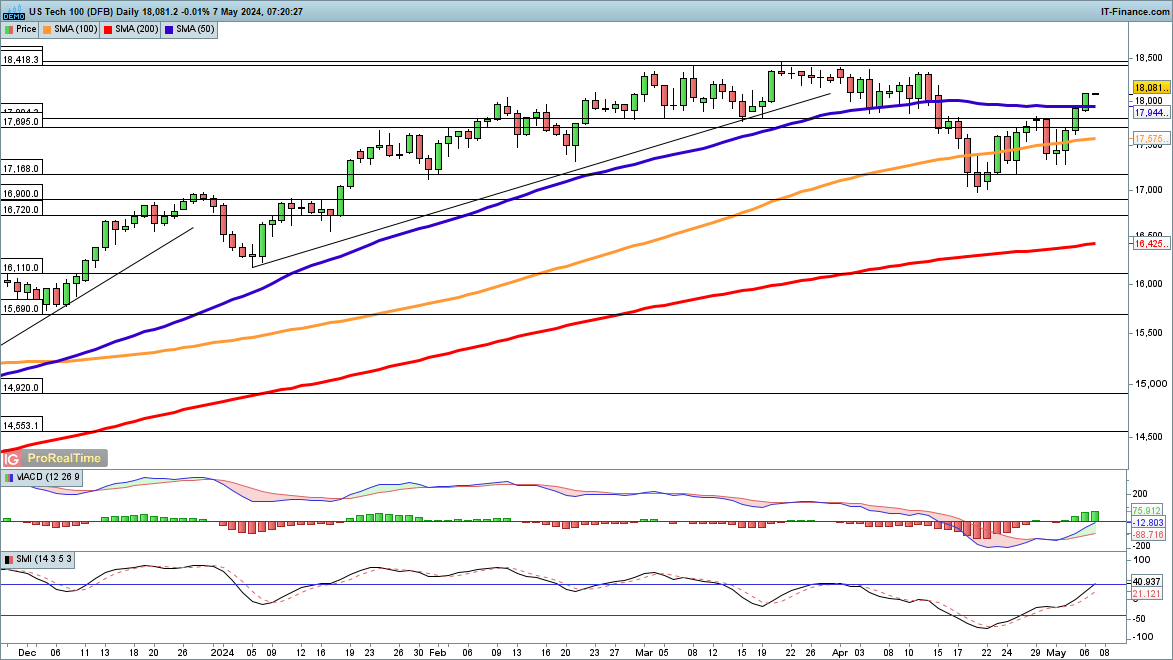

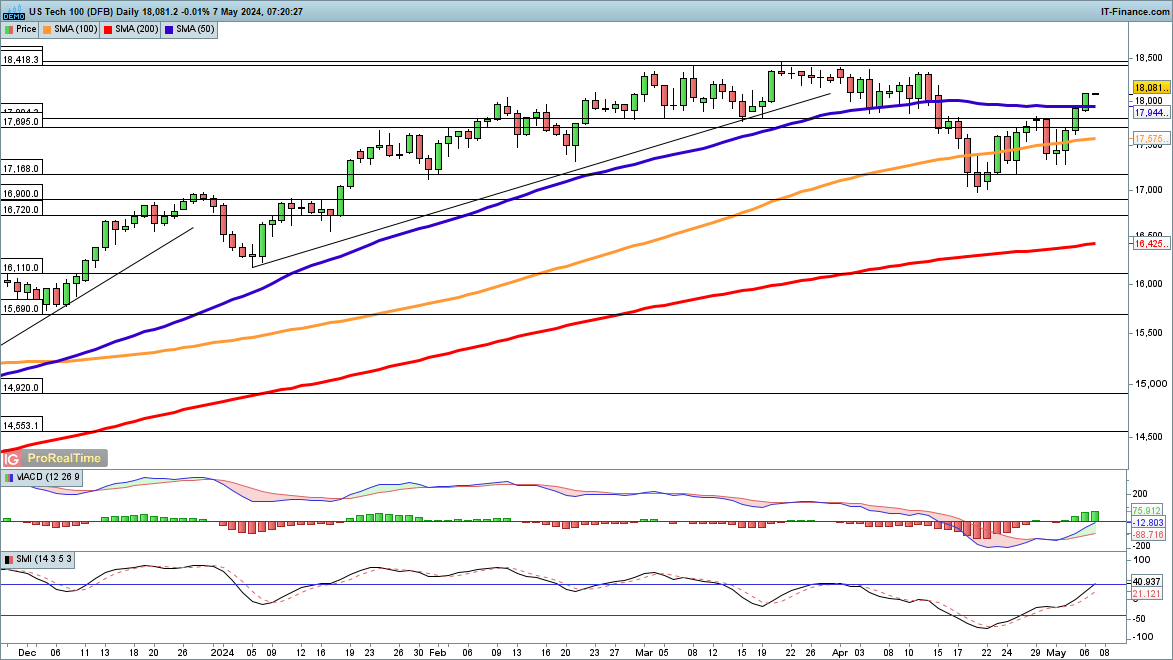

Nasdaq 100 Efficiency

The Nasdaq 100, just like the Dow, has recovered impressively, currently closing above the 50-day SMA and reaching its mid-April excessive of 16,700. With main tech outcomes out, eradicating a major danger factor, the index is positioned to retest its earlier file excessive of 18,420.

Nevertheless, a decline beneath 17,500 would reverse this bullish image, doubtlessly leading to a repeat of the April low of $17,000.

UK Financial Components and FTSE 100

The UK’s financial scenario has an impression on the FTSE 100’s efficiency. The Financial institution of England’s projected rate of interest cuts, which started in August, have devalued sterling, benefiting exporter-heavy equities within the index.

A survey indicating the quickest rise in British development exercise in additional than a yr added to the constructive vibe.

Regardless of these encouraging indicators, the UK confronts main hurdles, together with political uncertainty from the upcoming normal election and financial pressures from excessive nationwide debt and sticky inflation.

Sectoral and Firm Highlights

Valuable metallic miners and industrial help companies have been among the many sector’s high gainers, up 2.3% and a pair of.6%, respectively. In distinction, BP’s shares slid 1.3% on account of disappointing earnings, which have been damage by decreased oil costs and operational issues.

Shell, alternatively, gained 1.3% on studies of possible asset gross sales in Malaysia. The airline sector was beneath stress as Easyjet and Wizz Air shares fell sharply following Ryanair’s CEO’s issues about decrease summer time journey costs.

Market Outlook

Wanting forward, market traits point out continued volatility, with a mixture of development potential and imminent threats. Merchants ought to preserve an eye fixed out for Financial institution of England coverage bulletins and different macroeconomic elements that will affect market actions.

The subsequent normal election, and its outcomes, can be essential in defining future financial insurance policies and doubtlessly influencing market sentiment.

Total, whereas the indices are actually on an upward pattern, merchants must be cautious, bearing in mind each technical positions and bigger financial knowledge when making alternatives.