Gold hits a file excessive because the Federal Reserve confirms rate of interest cuts

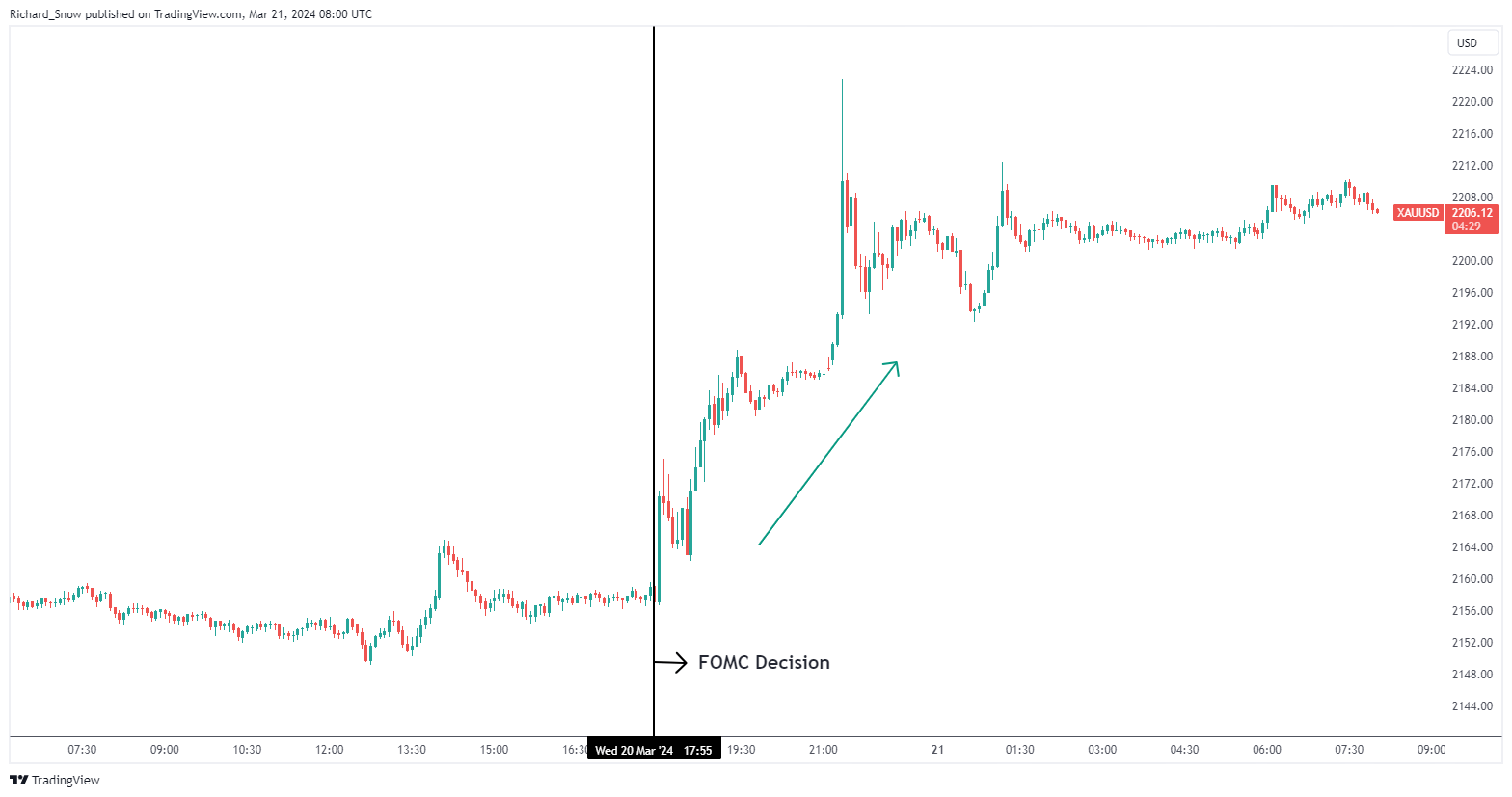

Gold costs have climbed to historic highs following the Federal Reserve’s most current financial coverage announcement. Regardless of adjustments in inflation and financial forecasts, the central financial institution’s choice to stay to its plan of three rate of interest cuts this yr has lifted gold considerably.

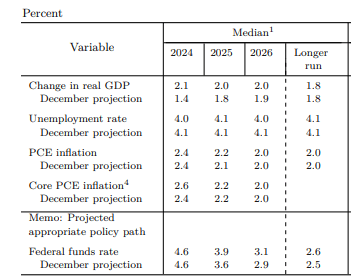

The Federal Reserve’s Abstract of Financial Projections for March 2024 highlighted varied modifications, together with a minimal improve within the long-term federal funds price from 2.5% to 2.6%. This transformation proposes revisiting the ‘impartial price,’ which balances financial progress with out being overly stimulative or restrictive.

Fed Abstract of Financial Projections, March 2024

Previous to the Fed’s assertion, the dialogue centered on whether or not the central financial institution would revise its rate-cutting forecast in gentle of current sturdy financial statistics and better inflation figures. Nevertheless, the Fed’s affirmation of its December predictions triggered a dovish market response, weakening the foreign money and reducing short-term yields just like the 2-year Treasury yield. This market dynamic supplied very best circumstances for gold to achieve a brand new all-time excessive.

Gold Soars to New All-Time Excessive

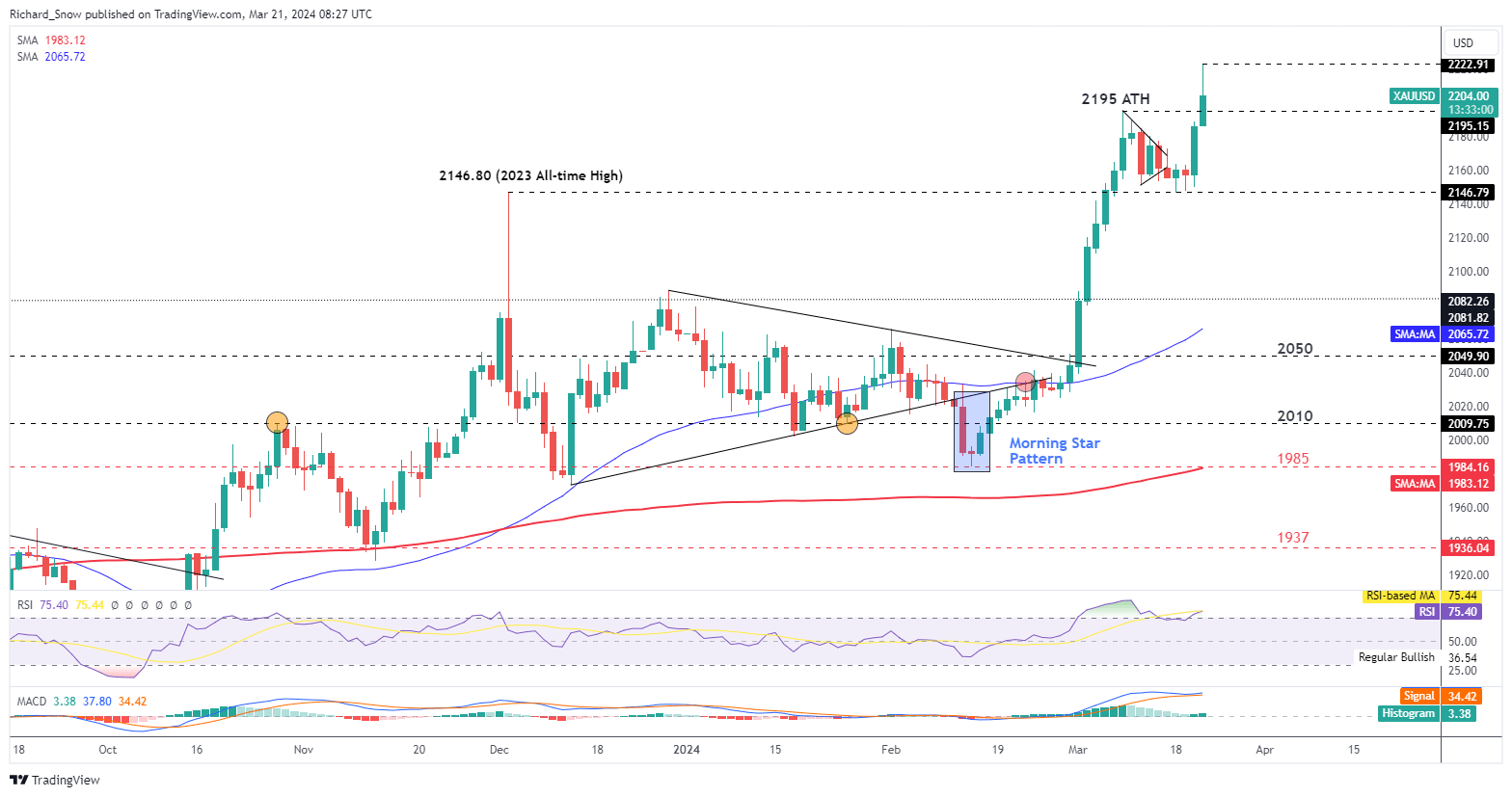

Gold’s rally continues following the FOMC assembly. Following Wednesday’s Federal Open Market Committee (FOMC) assembly, gold costs have continued to rise, establishing a brand new excessive. The dear steel’s value consolidated above the earlier all-time excessive of $2146.80, reaching over $2222. This rise was anticipated if gold costs held above the earlier excessive, indicating sturdy momentum within the gold market.

Day by day Gold (XAU/USD) Chart

The rise in gold costs can be aided by rising central financial institution purchases, notably from China. Regardless of the prospect of a short lived decline resulting from current massive motion and a possible greenback restoration, gold’s assist stays stable close to $2146. This growth demonstrates the dear steel’s enduring enchantment as a safe-haven asset in an unsure financial atmosphere.

Ultimate Ideas

Traders and sellers should constantly monitor these developments, notably the affect of Federal Reserve coverage on gold costs. The mixture of dovish Federal Reserve estimates and sturdy demand for gold factors to a continued bullish pattern for the dear steel, making a profitable alternative for buyers.

The put up Gold Surged to a New All-time Excessive After The Fed Reaffirmed Its Price Lower View appeared first on Dumb Little Man.