|

|

Metropolis Index Evaluation

Foreign exchange brokers play a pivotal position in offering entry to the overseas change market, the biggest monetary market globally. These brokers function intermediaries, enabling each retail and institutional merchants to purchase and promote foreign exchange. Within the crowded panorama of foreign exchange brokers, Metropolis Index stands out attributable to its complete choices and regulatory standing.

Metropolis Index is a famend world CFD dealer, distinguished by its adherence to regulation by a number of monetary authorities, together with the top-tier UK Monetary Conduct Authority (FCA). This dealer is well known for its aggressive low foreign currency trading charges and minimal non-trading charges, similar to low withdrawal charges. Furthermore, Metropolis Index simplifies the journey for brand new merchants with its quick and easy account opening course of, complemented by a collection of high-quality analysis instruments out there to its customers.

On this complete evaluation, our intention is to delve deep into the choices of Metropolis Index, highlighting its distinctive promoting propositions and any potential drawbacks. We’re dedicated to offering an exhaustive analysis, concerning key facets similar to account choices, deposit and withdrawal processes, and fee constructions. By integrating skilled evaluation with actual dealer experiences, our objective is to furnish you with very important data that can help in making an knowledgeable choice about choosing Metropolis Index as your go-to brokerage service supplier.

What’s Metropolis Index?

Metropolis Index serves as a distinguished world unfold betting, FX, and CFD Buying and selling supplier. This brokerage agency facilitates entry to a variety of markets, permitting merchants to invest on the worth actions of currencies, indices, and different monetary devices. It stands as a key participant for these excited by participating with the foreign exchange and CFD markets.

As a subsidiary of the Nasdaq listed StoneX Group, Metropolis Index boasts sturdy monetary backing and a stable popularity within the buying and selling group. The dealer operates below the strict supervision of a number of regulatory our bodies, together with the Monetary Conduct Authority (FCA) within the UK, the Australian Securities and Investments Fee (ASIC) in Australia, and the Financial Authority of Singapore (MAS) in Singapore. This regulatory framework ensures a excessive degree of dealer safety and operational integrity.

With operational bases in the UK, Australia, and Singapore, Metropolis Index affords world market entry to merchants from numerous jurisdictions. The presence of workplaces in these key monetary hubs underscores the dealer’s dedication to providing localized help and providers tailor-made to fulfill the wants of a various consumer base. This world footprint reinforces Metropolis Index’s place as a trusted and accessible dealer for merchants world wide.

Security and Safety of Metropolis Index

The protection and safety of Metropolis Index are paramount, with the dealer regulated by the distinguished British Monetary Conduct Authority (FCA). This data, meticulously researched by Dumb Little Man, highlights the dealer’s adherence to stringent regulatory requirements. The FCA imposes rigorous necessities on brokers to make sure the safety of merchants and the integrity of economic markets. Failure to adjust to these obligations may end up in the revocation of the dealer’s license, underscoring the seriousness of Metropolis Index’s regulatory compliance.

Metropolis Index enhances the protection of consumer funds by way of using segregated accounts. This follow ensures that buyer funds are stored separate from the corporate’s operational funds, providing a further layer of safety. Furthermore, within the unlikely occasion of economic discrepancies or violations, merchants are safeguarded by the Monetary Providers Compensation Scheme (FSCS), which affords compensation as much as £85,000. This assure of compensation is a important security internet for merchants, reflecting Metropolis Index’s dedication to consumer safety.

Moreover, the availability of a license from a good regulator just like the FCA, mixed with the operational transparency by way of segregated accounts and the FSCS safety, positions Metropolis Index as a safe buying and selling platform. Nevertheless, it’s famous that sure regulatory paperwork will not be publicly accessible, which could increase questions on transparency. Nonetheless, the dealer’s compliance with FCA rules, the use of segregated accounts, and FSCS safety are pivotal facets that affirm Metropolis Index’s dedication to security and safety within the buying and selling atmosphere.

Execs and Cons of Metropolis Index

Execs

- Extensive collection of buying and selling devices

- Affords each floating and stuck spreads

- Availability of MetaTrader 4, net, and cell platforms

- 2024 Annual Award for #1 Danger Administration Instrument: PlayMaker

- Metropolis Index cell app options built-in analysis and market insights

- Weekly era of 200 distinctive buying and selling indicators by way of SMART Alerts

Cons

- Occasional buying and selling platform points

- Restricted deposit and withdrawal choices

- Potential rejection of account functions based mostly on buying and selling expertise or capital

- No help for MetaTrader 5

Signal-Up Bonus of Metropolis Index

Metropolis Index is providing a compelling sign-up bonus for brand new merchants: the prospect to get pleasure from $888 cashback on their preliminary trades. This unique promotion is designed to welcome new customers by considerably lowering their buying and selling prices in the course of the first two months of account operation. To be eligible, merchants should open their account earlier than 31 March 2024.

This sign-up bonus stands out for its accessibility, because it imposes no minimal buying and selling quantity requirement. Which means merchants can qualify for as much as $888 cashback no matter their buying and selling frequency or the dimensions of their trades. It’s a superb alternative for these trying to kickstart their buying and selling journey with Metropolis Index, becoming a member of a group of over one million merchants who profit from aggressive buying and selling situations and strong platform options.

Metropolis Index Account Sorts

After thorough testing and analysis by our group of specialists at Dumb Little Man, it was found that Metropolis Index affords two main account varieties to accommodate the various wants of its merchants. These accounts are designed to cater to each novice and skilled merchants by offering an atmosphere that matches their buying and selling expertise and danger tolerance. Right here’s a clear and arranged checklist of the account varieties out there at Metropolis Index:

- Actual Account: This account is tailor-made for skilled merchants, permitting them to have interaction in buying and selling operations with all of the supplied belongings in real-time. The buying and selling situations fluctuate based mostly on the belongings chosen by the dealer. It’s designed to supply a real buying and selling atmosphere the place merchants can apply their methods and data in a dynamic market setting.

- Demo Account: Aimed toward merchants trying to check the buying and selling situations of Metropolis Index or those that want to strive new methods with out monetary danger. Whereas the demo account affords a risk-free buying and selling expertise, it’s essential to notice that no actual revenue could be accrued. This account sort supplies a superb alternative for inexperienced persons to familiarize themselves with the platform and for knowledgeable merchants to refine their methods.

Metropolis Index Buyer Evaluations

Buyer evaluations of Metropolis Index reveal a combined expertise with the platform’s providers. On one hand, customers commend the help group for his or her helpfulness, particularly in resolving technical points similar to system updates crucial for buying and selling operations. This means a responsive and supportive customer support method for technical difficulties.

Alternatively, some merchants specific frustration over monetary facets, together with perceived extreme fees throughout inactive buying and selling intervals, just like the vacation season, and challenges with account closure and fund withdrawal. These accounts spotlight issues over monetary transparency and operational effectivity, notably in dealing with withdrawals and explaining fees

Metropolis Index Charges, Spreads, and Commissions

Metropolis Index stands out for its clear charge construction, guaranteeing merchants face no hidden charges. This transparency is a key side of their providing, making it simpler for merchants to handle their funds with out worrying about surprising fees. Importantly, Metropolis Index doesn’t impose commissions on deposits or withdrawals, whatever the fee methodology used. This coverage applies throughout all out there fee methods, offering flexibility and cost-efficiency for merchants managing their funds.

Merchants at Metropolis Index profit from the choice to decide on between floating and stuck spreads, with the unfold measurement various in response to the buying and selling instrument. This flexibility permits merchants to pick out spreads that greatest go well with their buying and selling fashion and technique. Moreover, Metropolis Index applies a fastened fee for swaps when transferring a place to the subsequent day. This charge, associated to holding positions in a single day, is a typical side of buying and selling prices and is clearly outlined to make sure merchants can plan their buying and selling actions with full consciousness of potential fees.

Deposit and Withdrawal

Based on thorough testing by a buying and selling skilled at Dumb Little Man, Metropolis Index supplies a streamlined deposit and withdrawal course of. The dealer ensures that withdrawing funds is hassle-free, requiring merely an software with out imposing any fee for the operation. This coverage extends to fee methods as effectively, highlighting Metropolis Index‘s dedication to cost-effective cash administration for its shoppers.

For withdrawals, merchants have the flexibleness to make use of both Visa or MasterCard financial institution playing cards, or go for the financial institution switch methodology. This selection caters to the preferences of various merchants, guaranteeing comfort and effectivity in accessing their funds. The dealer impresses with a fast turnaround, as funds usually replicate on a consumer’s card inside 24 hours, demonstrating Metropolis Index’s effectivity in processing transactions.

Furthermore, Metropolis Index helps transactions in a number of main fiat currencies, together with EUR, USD, and GBP. This forex versatility is advantageous for merchants globally, permitting them to deposit and withdraw funds within the forex that most closely fits their monetary state of affairs. The inclusion of those broadly used currencies underscores Metropolis Index’s world method to buying and selling, accommodating a various clientele.

The right way to Open an Metropolis Index Account

- Begin by clicking “Create account” on the principle web page.

- Enter private particulars similar to title, start date, e-mail, and telephone quantity, and choose your buying and selling devices.

- Present your tackle, metropolis, postal code, citizenship, and tax identification quantity.

- Fill in employment standing, buying and selling expertise, and monetary particulars like revenue and preliminary deposit quantity.

- Affirm your software, acknowledging the dangers of market buying and selling and arrange most popular notification strategies.

Metropolis Index Affiliate Program

Metropolis Index affords a complete associates program designed to cater to varied companions, from people to firms. This system is structured to reward associates, representing brokers, and white label companions, every with particular advantages tailor-made to their contribution.

Associates obtain a bonus for every referral consumer they convey to Metropolis Index by way of a person referral hyperlink. This construction incentivizes the promotion of Metropolis Index’s buying and selling providers, benefiting each the affiliate and the dealer.

Representing Brokers are a part of a scheme that enables brokerage corporations to earn commissions for each transaction made by a referred consumer. This program helps brokerage corporations in increasing their service choices and enhancing their income streams.

White Labels are corporations aiming to supply their shoppers entry to a broader vary of markets below their very own model. Metropolis Index companions with these corporations, offering a platform for them to increase their market attain with out compromising their model identification.

Lastly, this system consists of Trade-traded futures, providing companion corporations’ shoppers entry to over 30 by-product exchanges throughout america, Europe, Asia, and the Center East. This element of the associates program permits companions to supply their shoppers a diversified buying and selling portfolio.

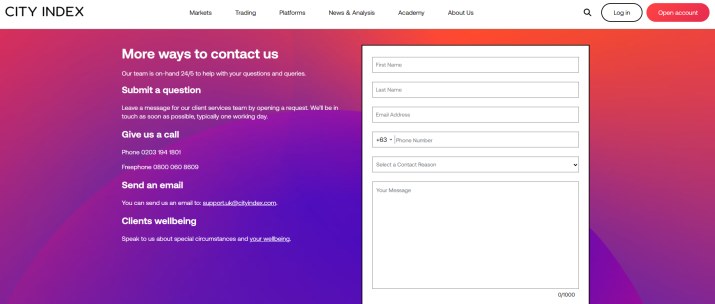

Metropolis Index Buyer Help

Metropolis Index affords complete buyer help choices, guaranteeing that merchants can simply entry help every time wanted. Primarily based on experiences documented by Dumb Little Man, the dealer supplies a number of channels for contacting help, together with native and worldwide telephone calls, e-mail correspondence, and dwell chat on the dealer’s web site. These diversified communication strategies cater to the various wants and preferences of merchants across the globe.

Merchants can provoke help requests immediately from the Metropolis Index web site or by way of their private account, making the method of in search of assist simple and user-friendly. This flexibility in accessing help providers highlights Metropolis Index’s dedication to providing a seamless and responsive customer support expertise. The provision of various contact strategies ensures that merchants can discover help with minimal delay, enhancing the general buying and selling expertise with Metropolis Index.

Benefits and Disadvantages of Metropolis Index Buyer Help

Metropolis Index vs Different Brokers

#1. Metropolis Index vs AvaTrade

Metropolis Index affords a big selection of buying and selling devices, strong regulatory compliance throughout a number of jurisdictions, and is thought for its modern buying and selling instruments like PlayMaker. It serves a world viewers with a concentrate on offering low foreign currency trading charges and superior buying and selling platforms. AvaTrade, alternatively, has a big world presence since 2006, with a powerful dedication to offering a complete on-line buying and selling expertise. It affords greater than 1,250 monetary devices and is famend for its heavy regulation and licensing, guaranteeing excessive ranges of dealer safety.

Verdict: For merchants prioritizing an unlimited collection of buying and selling devices and superior instruments, Metropolis Index would be the more sensible choice. Nevertheless, for these valuing a closely regulated atmosphere with a variety of economic devices, AvaTrade stands out. Given the strong regulatory framework and broader world attain, AvaTrade may edge out for merchants valuing safety and selection.

#2. Metropolis Index vs RoboForex

Metropolis Index shines with its regulatory compliance, together with top-tier UK FCA oversight, low buying and selling charges, and a broad vary of buying and selling instruments. RoboForex, established in 2009, distinguishes itself with excellent buying and selling situations, cutting-edge applied sciences, and an unlimited collection of over 12,000 buying and selling choices throughout eight asset courses. It’s recognized for its huge number of buying and selling platforms and personalised buying and selling phrases appropriate for numerous buying and selling types.

Verdict: Whereas Metropolis Index affords a stable, regulated buying and selling atmosphere with aggressive charges, RoboForex supplies a extra numerous buying and selling platform choice and a wider vary of buying and selling devices. For merchants in search of technological range and an unlimited array of buying and selling choices, RoboForex could also be the popular selection.

#3. Metropolis Index vs FXChoice

Metropolis Index stands out for its complete buying and selling options, regulatory safeguards, and modern buying and selling instruments. FXChoice, established in 2010 and controlled by the Worldwide Monetary Providers Fee of Belize, focuses on integrity and customer-oriented providers. It caters primarily to skilled merchants with its supply of basic {and professional} ECN accounts, alongside providers tailor-made for automated buying and selling.

Verdict: Metropolis Index affords a extra strong regulatory atmosphere and a broader vary of analysis instruments, making it appropriate for merchants who worth safety and superior buying and selling options. FXChoice, with its concentrate on skilled merchants and emphasis on automated buying and selling options, may enchantment extra to these in search of specialised ECN accounts and automatic buying and selling choices. For general safety and power range, Metropolis Index could possibly be thought-about the higher choice.

>> Additionally Learn: AvaTrade Evaluation 2024 By Dumb Little Man: Is It The Finest Total Dealer?

Select Asia Foreign exchange Mentor for Your Foreign exchange Buying and selling Success

In case your objective is to forge a profitable profession in foreign currency trading and safe important monetary success, Asia Foreign exchange Mentor is your premier vacation spot for top-tier foreign exchange, inventory, and crypto buying and selling training. Ezekiel Chew, celebrated for his contributions to buying and selling establishments and banks, is the mastermind behind Asia Foreign exchange Mentor. It’s noteworthy that Ezekiel persistently secures trades within the seven-figure vary, marking him as a standout amongst buying and selling educators. The next factors spotlight why we advocate Asia Foreign exchange Mentor:

Complete Curriculum: Asia Foreign exchange Mentor delivers an intensive academic package deal encompassing foreign exchange, inventory, and crypto buying and selling. This curriculum is designed to arm budding merchants with the experience and strategies wanted to thrive in these diversified monetary landscapes.

Confirmed Monitor File: The popularity of Asia Foreign exchange Mentor is solidly backed by its historical past of nurturing merchants who persistently obtain income in several market areas. This report attests to the excessive efficacy of their educating methods and mentorship.

Skilled Mentor: College students at Asia Foreign exchange Mentor obtain instruction and insights from a mentor with a confirmed report of success in foreign exchange, inventory, and crypto buying and selling. Ezekiel’s hands-on help ensures college students can confidently deal with the complexities of the markets.

Supportive Neighborhood: Enrollment in Asia Foreign exchange Mentor grants entry to a collaborative group of merchants centered on succeeding in foreign exchange, inventory, and crypto buying and selling. This atmosphere encourages sharing, collaboration, and mutual studying, enriching the tutorial journey.

Emphasis on Self-discipline and Psychology: Attaining buying and selling success requires a resilient mindset and a disciplined method. Asia Foreign exchange Mentor emphasizes psychological coaching to help merchants in managing their feelings, dealing with stress, and making sound buying and selling selections.

Fixed Updates and Sources: With the ever-evolving nature of economic markets, Asia Foreign exchange Mentor retains its college students abreast of latest tendencies, strategies, and market developments. Ongoing entry to those assets ensures merchants stay aggressive.

Success Tales: Asia Foreign exchange Mentor boasts quite a few testimonials from college students who’ve drastically modified their buying and selling careers and reached monetary independence, because of their complete training in foreign exchange, inventory, and crypto buying and selling.

For people wanting to navigate the foreign exchange, inventory, and crypto buying and selling landscapes efficiently and attain monetary progress, Asia Foreign exchange Mentor stands because the optimum academic platform. With its detailed curriculum, expert mentors, sensible coaching method, and supportive group, Asia Foreign exchange Mentor equips aspiring merchants with all the mandatory assets and help to evolve into proficient professionals in numerous monetary markets.

Conclusion: Metropolis Index Evaluation

In conclusion, the group of buying and selling specialists at Dumb Little Man has performed an intensive evaluation of Metropolis Index, figuring out it as a good and aggressive dealer within the foreign exchange and CFD buying and selling panorama. Metropolis Index impresses with its big selection of buying and selling devices, aggressive spreads, and entry to each MetaTrader 4 and proprietary buying and selling platforms. These options, mixed with the award-winning PlayMaker software and complete cell app, place Metropolis Index favorably for merchants in search of a sturdy buying and selling atmosphere.

Nevertheless, potential merchants ought to concentrate on the periodic malfunctions of the buying and selling platform, a restricted number of deposit and withdrawal strategies, and the standards for account opening which will exclude much less skilled merchants or these with inadequate capital. The absence of MetaTrader 5 may also be a downside for some customers.

>> Additionally Learn: Fusion Markets Evaluation with Rankings 2024 By Dumb Little Man

Metropolis Index Evaluation FAQs

What varieties of accounts does Metropolis Index supply?

Metropolis Index supplies two principal varieties of accounts to accommodate the wants of various merchants: an actual account and a demo account. The true account is designed for knowledgeable merchants, permitting them to execute trades with all supplied belongings in real-time, with buying and selling situations various by the belongings used. The demo account allows merchants to check the corporate’s buying and selling situations or check out new methods with none monetary danger, as no actual cash is concerned in trades made inside this account sort.

How does Metropolis Index deal with deposits and withdrawals?

Metropolis Index affords a simple course of for deposits and withdrawals, not charging any commissions for these operations. Merchants can use Visa or MasterCard financial institution playing cards or go for a financial institution switch when withdrawing funds. The everyday time for funds to be credited to a consumer’s card is round 24 hours, making the method environment friendly and user-friendly. Accessible currencies for these transactions embrace EUR, USD, and GBP, offering flexibility for world merchants.

Is Metropolis Index a protected dealer to commerce with?

Metropolis Index prioritizes the protection and safety of its shoppers’ funds and private data. It’s regulated by a number of top-tier monetary authorities, together with the UK’s Monetary Conduct Authority (FCA). Moreover, Metropolis Index makes use of segregated accounts to maintain consumer funds separate from its personal, enhancing monetary safety. The dealer can be a part of the Monetary Providers Compensation Scheme (FSCS), providing compensation as much as £85,000 in case of economic irregularities, which underscores its dedication to dealer safety.