Crude Oil Value Fluctuations

US crude oil costs surrendered their preliminary positive aspects in Europe on Wednesday, though they remained inside the market’s current buying and selling vary.

Elements Influencing Early Help

The vitality sector acquired an preliminary enhance following a report that confirmed a major discount in US crude inventories. The American Petroleum Institute revealed a decline of 3.01 million barrels for the week ending Might 10, considerably exceeding expectations and contrasting sharply with the earlier week’s enhance.

Persistent Demand Worries

Regardless of these stock attracts, considerations concerning the sustainability of demand persist. The Worldwide Vitality Company lowered its 2024 oil-demand projection on Wednesday, foreseeing a rise of solely 1.1 million barrels per day, down 140,000 barrels from earlier estimates. This revision displays broader apprehensions a few potential oversupply, regardless of ongoing manufacturing cuts by OPEC and its allies.

Financial Indicators and Influence on Charges

The uncertainty across the timing of rate of interest reductions within the US and different superior economies stays excessive. Inflation tendencies are aligning with coverage targets, however fluctuating US producer costs point out potential challenges forward. Central banks are cautious about easing charges prematurely, aiming to make sure lasting impacts on inflation.

Geopolitical Tensions and Provide Dangers

Geopolitical conflicts and pure disasters proceed to underpin oil costs. Ongoing unrest in Ukraine and Gaza, together with a major wildfire close to Fort McMurray—an important website for Canadian oil sands manufacturing—increase considerations about provide disruptions.

Upcoming Market Information

Additional insights are anticipated with the upcoming launch of stock knowledge by the Vitality Info Administration on Wednesday.

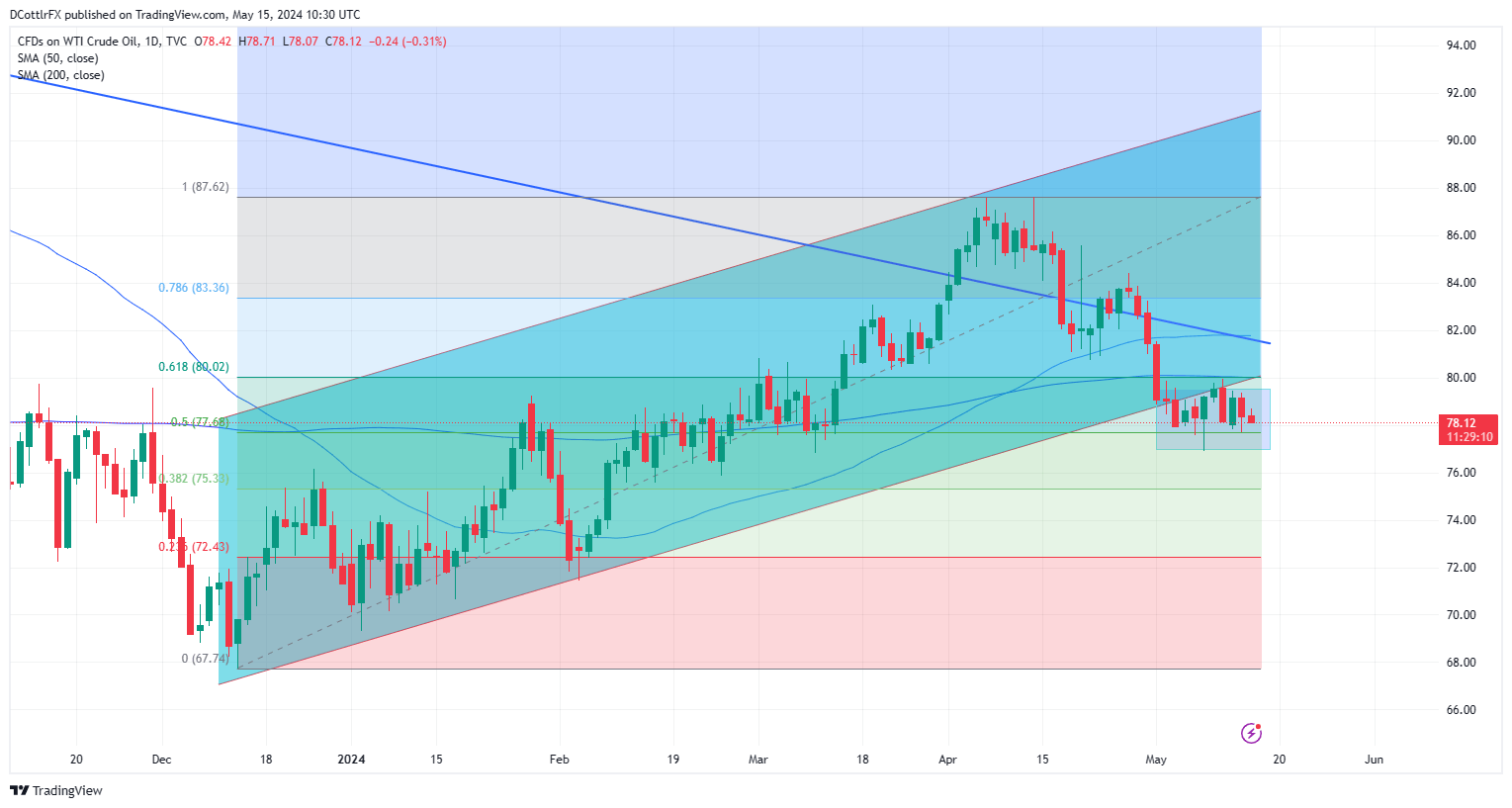

The battle to take care of help above the $78.00 stage continues, with the market oscillating between $79.44 and $76.86. Key technical indicators recommend a consolidating market, with potential resistance approaching from a downtrend line that began in mid-2022. The power of bulls to maintain costs above the 50- and 200-day shifting averages could possibly be essential in figuring out the market’s path within the close to time period. Traders stay watchful, anticipating clearer alerts by the week’s finish.

The publish US Crude Oil Reverses Early Good points Amid Renewed Demand Issues appeared first on Dumb Little Man.