Japanese Officers’ Feedback Fail to Enhance Yen

In a single day feedback from Japanese officers didn’t strengthen the Japanese Yen, with USD/JPY rising to highs final seen in late April. Financial institution of Japan Governor Kazuo Ueda highlighted his give attention to FX ranges and their influence on import costs.

Japan’s PM Fumio Kishida emphasised the necessity for versatile coverage to finish deflation and spur development. Regardless of these remarks, the Yen continued its decline, approaching ranges beforehand topic to FX intervention.

The Financial institution of Japan not too long ago introduced a discount in its bond-buying program, with particular particulars to be disclosed on the BoJ assembly on July thirty first. And not using a important drop within the US greenback, the BoJ might have to intervene to assist the Yen, as verbal interventions are proving ineffective.

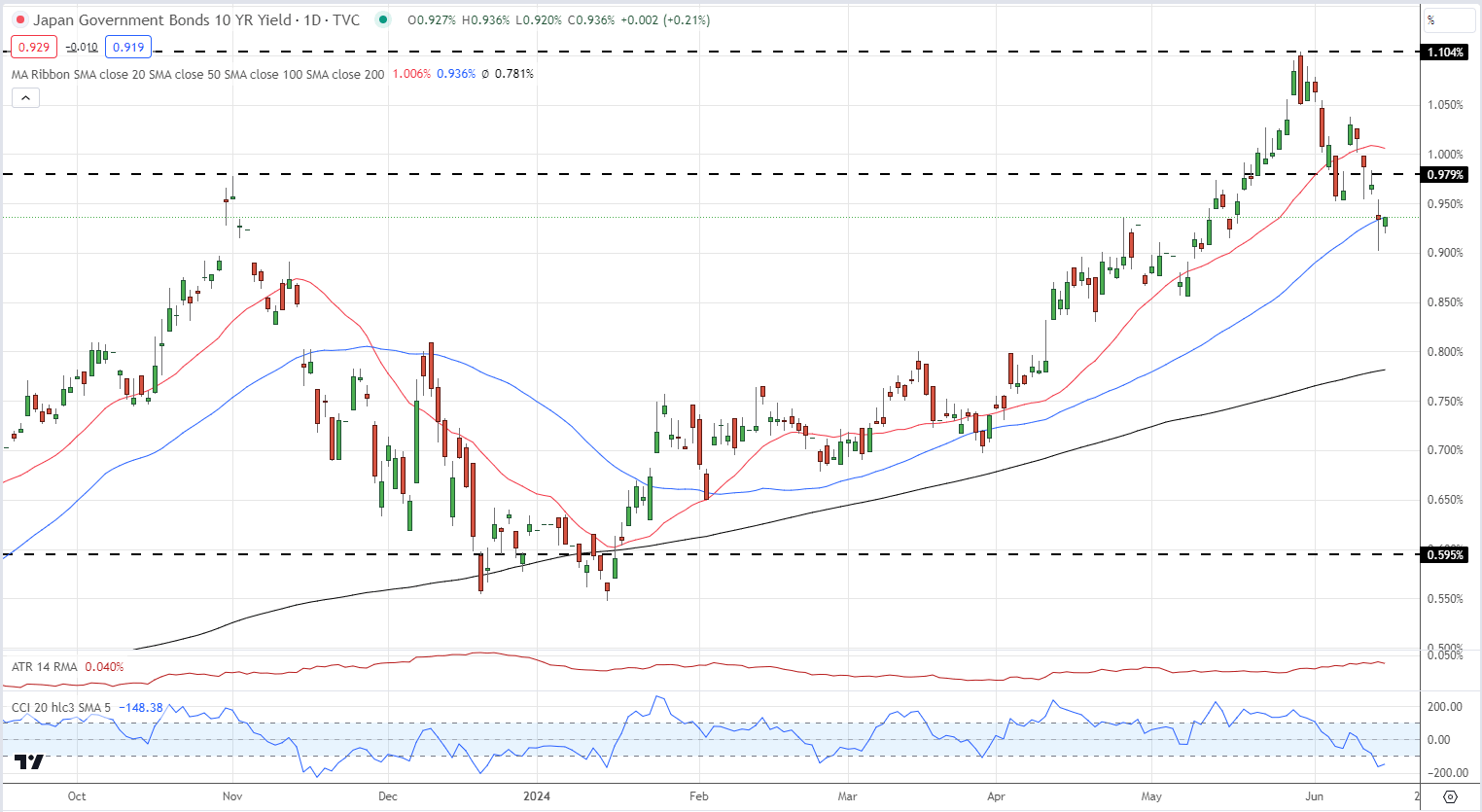

10-Yr JGB Yield Faces Resistance

For the reason that begin of 2024, the yield on the 10-year Japanese Authorities Bond (JGB) has been trending increased. Nonetheless, this upward motion skilled a pointy reversal on the finish of Could, resulting in market hypothesis in regards to the timing of financial coverage tightening by the BoJ.

Buyers are questioning when the BoJ will shift in direction of tightening, creating uncertainty within the bond market. This uncertainty is contributing to the yield struggling to make important positive aspects within the quick time period.

Moreover, the BoJ’s cautious stance on bond-buying reductions is including to the resistance, as buyers await clearer alerts from policymakers. With out decisive motion from the BoJ, the yield is more likely to face continued resistance, stopping it from transferring appreciably increased.

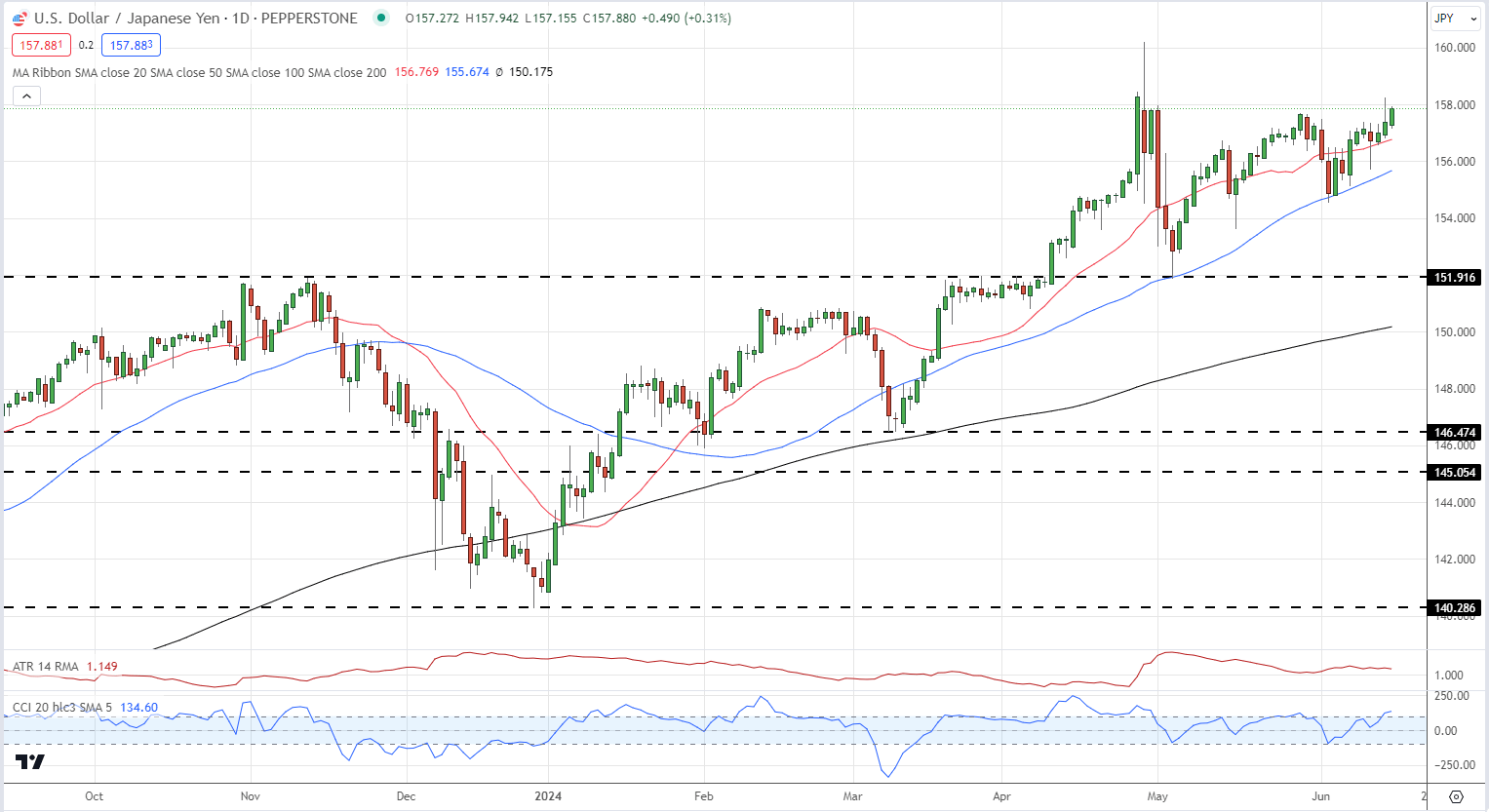

USD/JPY Each day Worth Chart Indicators Uptrend

The each day USD/JPY chart stays optimistic, regardless of the Commodity Channel Index (CCI) indicating overbought situations. The pair at the moment are above all three easy transferring averages and are poised to hit a brand new multi-week excessive. Above the 158 stage, resistance is minimal earlier than reaching the current multi-decade excessive at 160.215.

Retail dealer information exhibits 25.87% of merchants are net-long, with a short-to-long ratio of 2.87 to 1. The variety of net-long merchants has elevated by 11.66% from yesterday and 4.94% from final week, whereas net-short merchants are up by 5.87% from yesterday and 2.52% from final week.

Sometimes, a contrarian view means that the net-short place of merchants might result in additional USD/JPY value will increase. Nonetheless, the lower in net-short positions in comparison with yesterday and final week alerts a attainable pattern reversal, regardless of merchants remaining net-short.

The submit USD/JPY Nearing Multi-Week Highs: Will the BoJ Intervene by July? appeared first on Dumb Little Man.