Declining USD Amid Weaker Knowledge

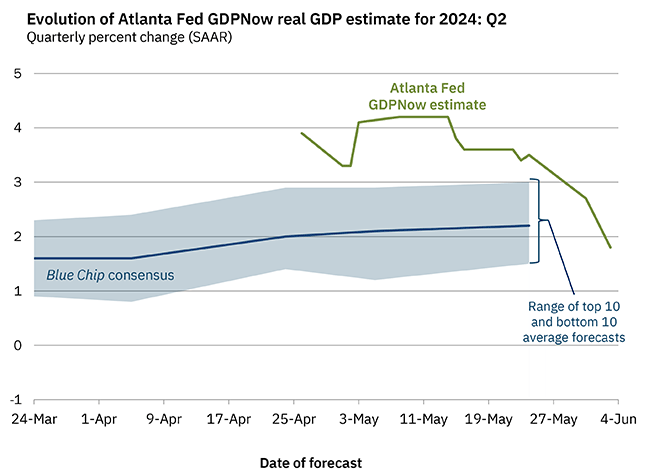

Financial information for the US exhibits a notable decline. Financial progress is slowing, as indicated by the Atlanta Fed’s GDPNow forecast, which dropped from over 4% to a mere 1.8% for Q2. This follows a disappointing Q1 progress of 1.6%, far beneath the anticipated 2.5%.

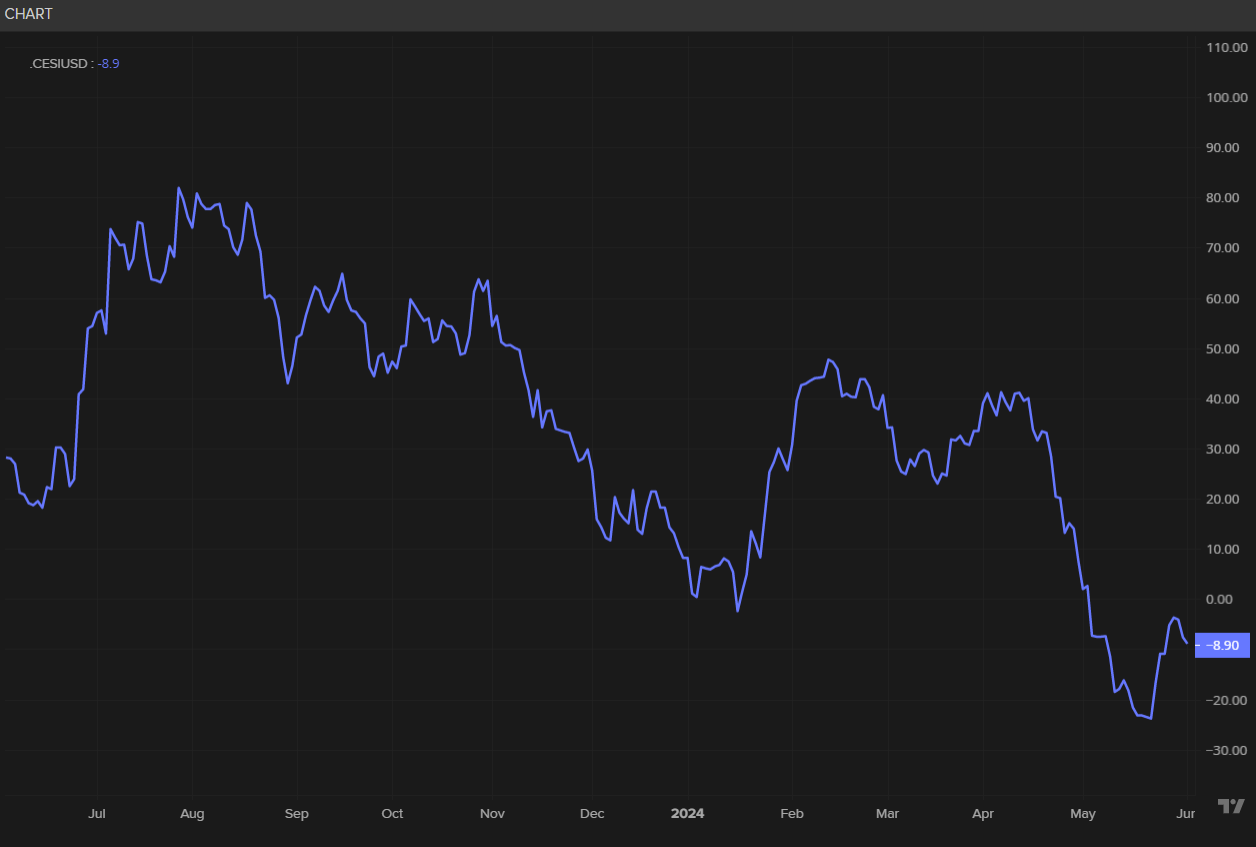

Moreover, April’s CPI and PCE inflation information counsel the disinflation pattern is returning, offering some aid for the Fed because it plans the timing for reducing rates of interest. Current information, together with the ISM manufacturing PMI survey, signifies weaker-than-expected outcomes. The US financial shock index has additionally continued its downward pattern.

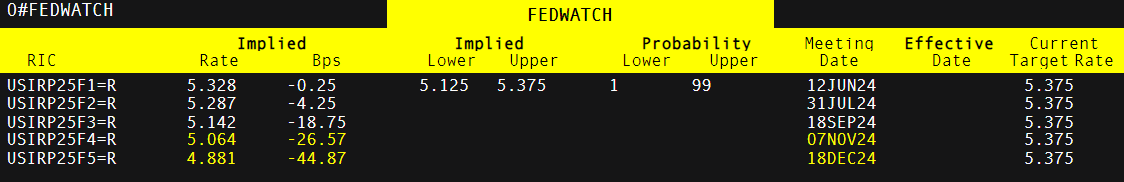

Markets expect at the least one fee lower this 12 months, probably two. Nonetheless, the timing is unsure as a result of upcoming elections, making September and December the almost definitely months for fee changes.

EUR/USD Eyes ECB Fee Choice

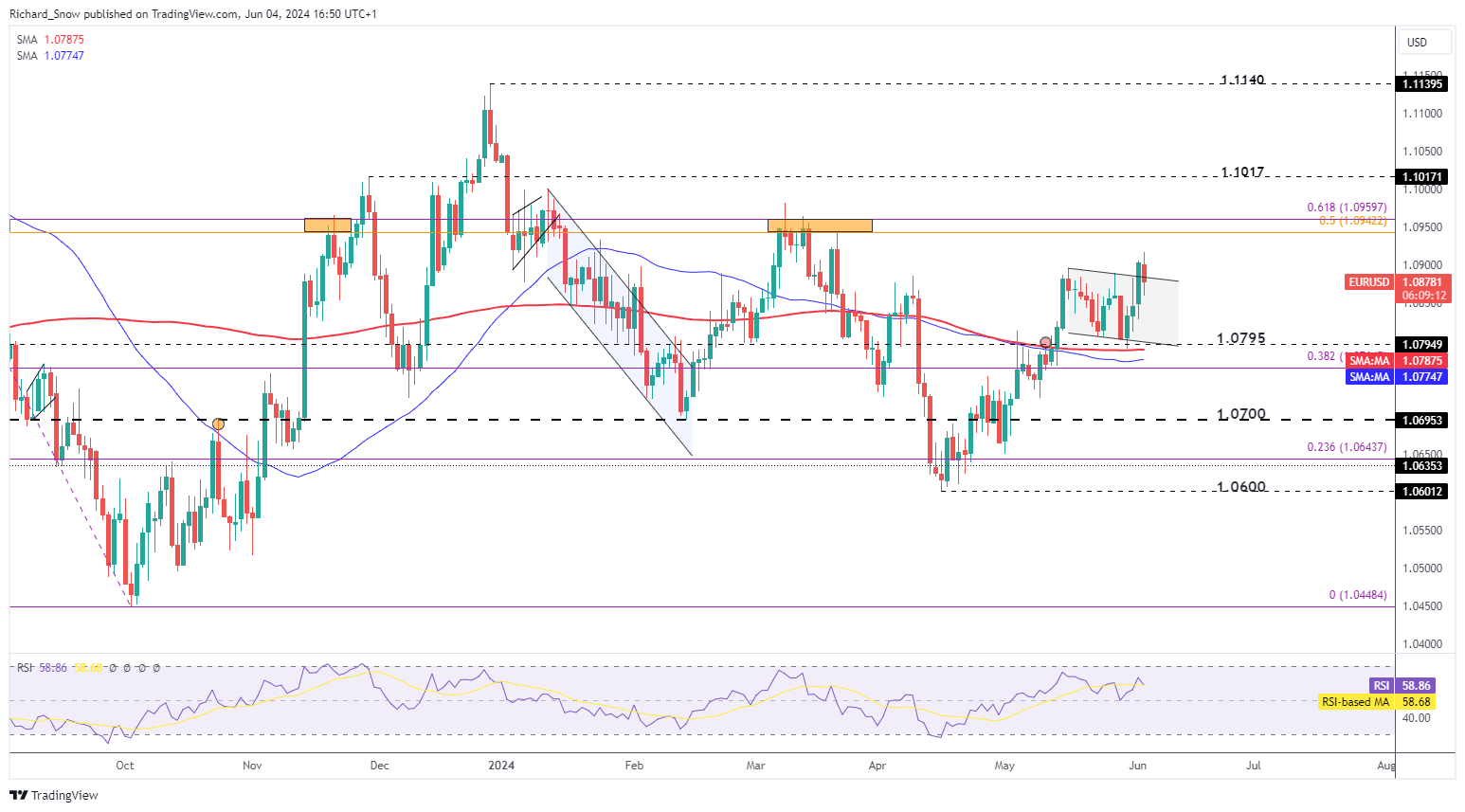

The ECB is making ready for its first fee lower after a interval of fast fee hikes. Market reactions is perhaps muted, as many officers have already pointed to June as a possible date for fee reductions. The main focus will probably be on the long run path of fee cuts, although the ECB has communicated a cautious method, avoiding the expectation of successive cuts.

EUR/USD has been trying a bullish breakout, supported by softer US information. For a sustained transfer greater, US information must weaken additional. A hawkish ECB lower may increase EUR/USD, although this can be a difficult technique. Draw back dangers for EUR/USD embrace a possible return to 1.0800 and channel assist.

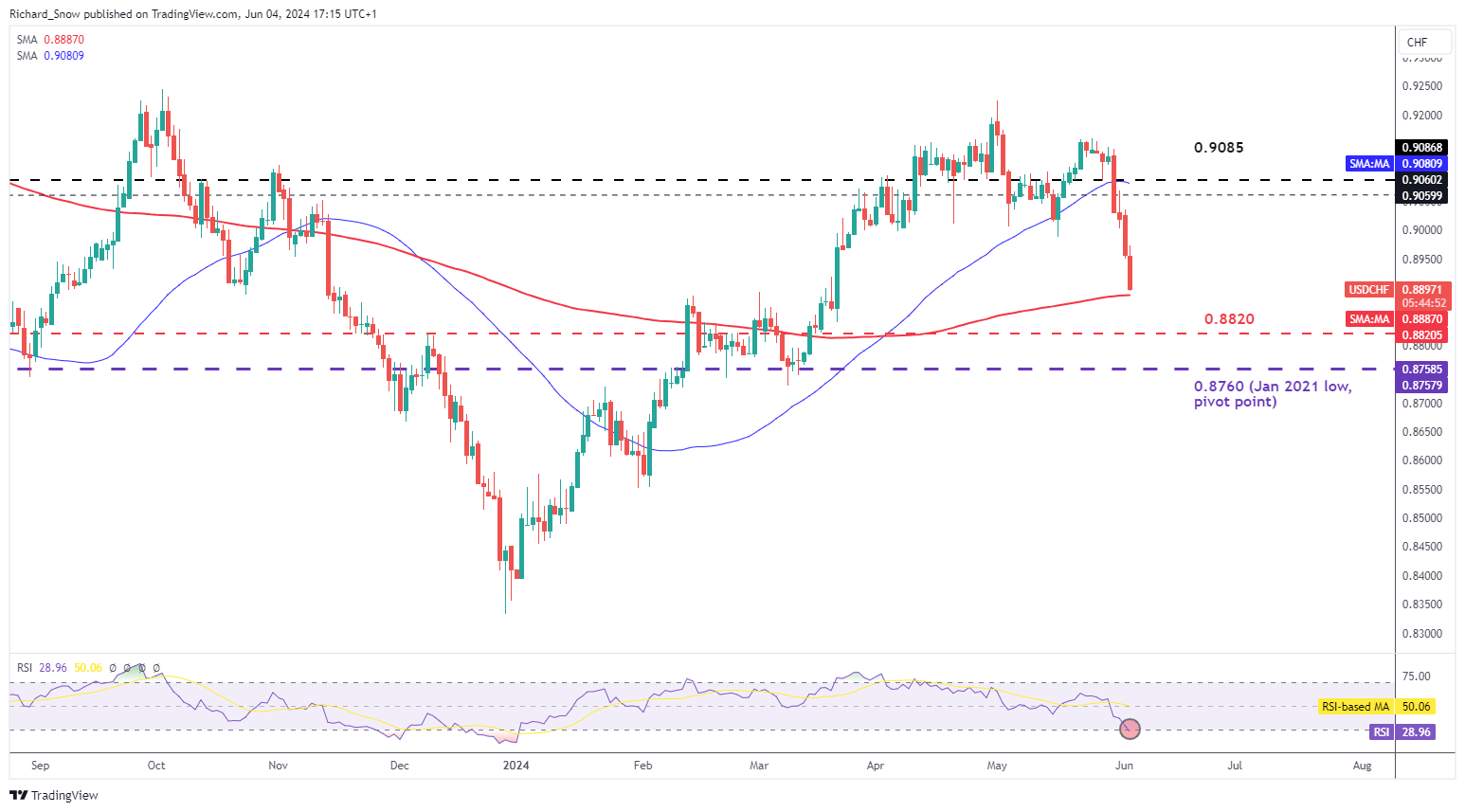

Swiss Franc Features Regardless of Overheating Alerts

USD/CHF has seen important declines, with the 200-day easy shifting common (SMA) and the RSI indicating oversold circumstances. The Swiss franc has strengthened after feedback from Swiss Nationwide Financial institution Chairman Thomas Jordan, who warned of the dangers posed by a weaker franc to inflation. The SNB had already lower charges in March, resulting in a depreciation in opposition to G7 currencies.

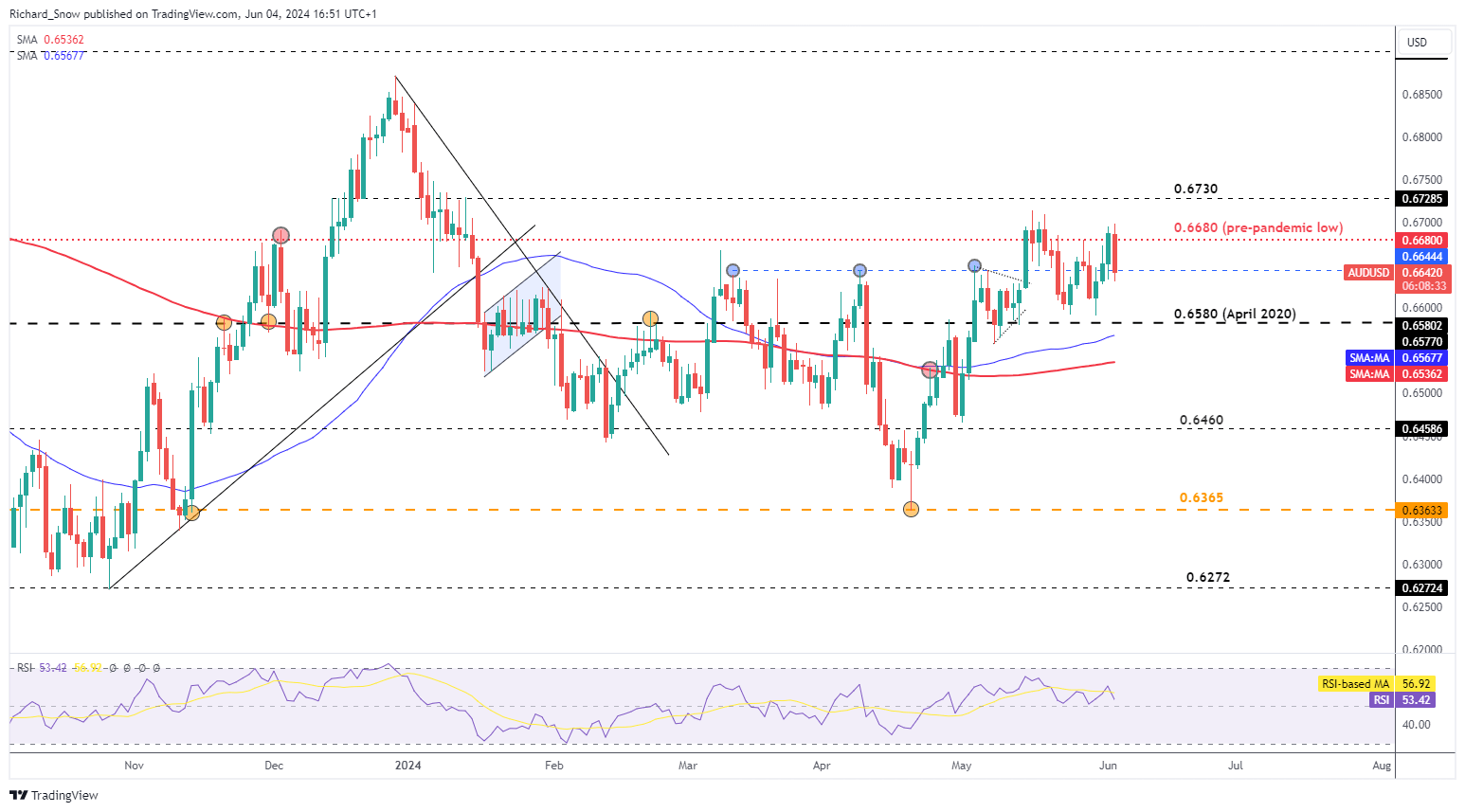

USD Bulls Goal Decrease AUD/USD Amid Weak Danger Urge for food

In a stronger USD situation, AUD/USD is price watching. The Australian greenback may lose momentum as danger urge for food declines. The foreign money typically correlates with the S&P 500, which has began the week decrease. This is perhaps because of a cautious market forward of Friday’s NFP information.

Metals, together with gold, silver, copper, and iron ore, have seen declining costs. Iron ore, Australia’s foremost export to China, is dealing with diminished demand from the financial big. AUD/USD didn’t retest its latest excessive of 0.6714 and has since eased decrease, with key ranges at 0.6644 and 0.6580 in focus.

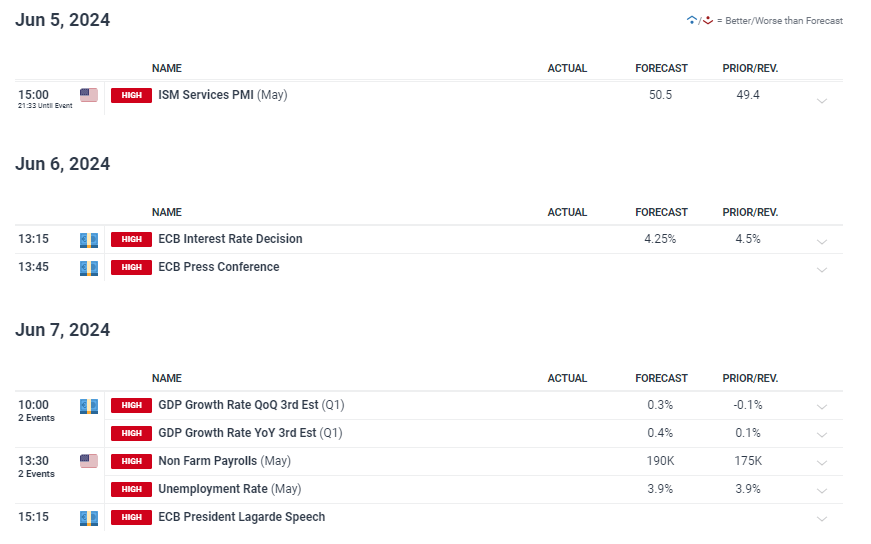

Key Upcoming Occasions

Upcoming US companies PMI information will probably be essential, with the ECB’s fee lower announcement on Thursday and the US NFP and common hourly earnings information on Friday being the principle highlights.

The put up USD Worth Motion: EUR/USD, AUD/USD, USD/CHF Key Ranges appeared first on Dumb Little Man.