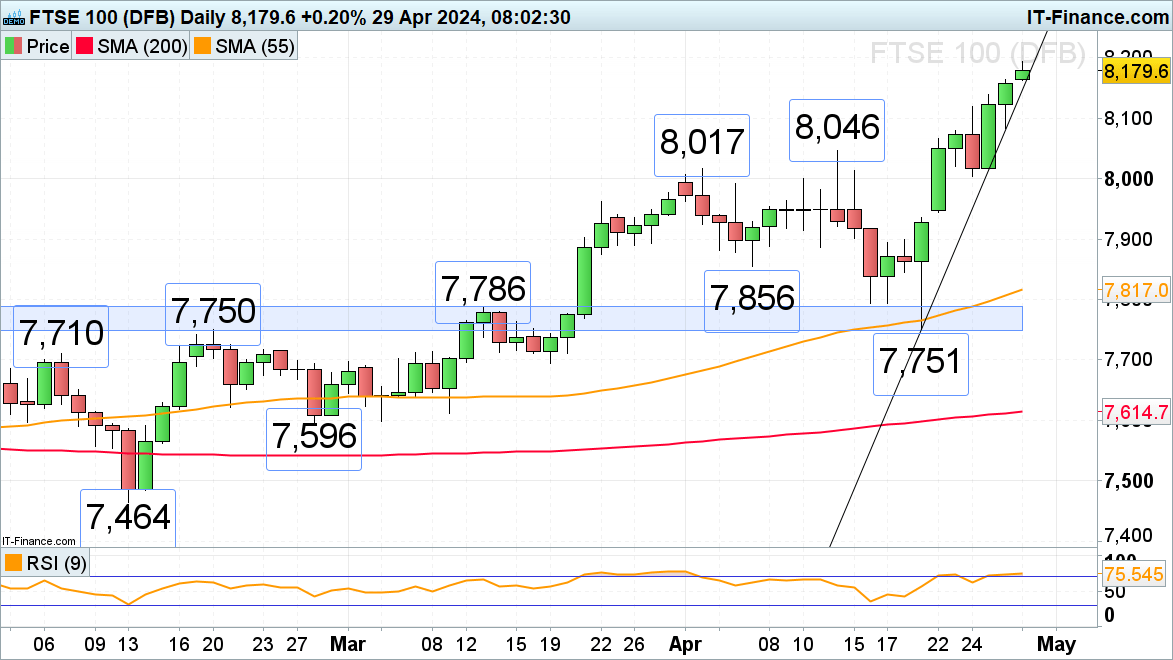

FTSE 100 Surges to File Ranges

The FTSE 100 has soared to unprecedented heights, nearing the 8,200 stage, as international buyers flock to the UK’s undervalued blue-chip shares. The subsequent important milestone is round 8,300, highlighted by the 161.8% Fibonacci extension from the 2020 rally, originating from the October 2020 low.

Help is discovered close to 8,148, nestled between current highs from April and the lows recorded final Wednesday, starting from 8,046 to eight,003.

Retail dealer knowledge signifies a bullish sentiment with 17.71% of merchants positioned lengthy. The dealer ratio of brief to lengthy stands at 4.65 to 1. Comparatively, in the present day sees a 2.21% improve in lengthy positions and a 44.70% rise briefly positions from final week, reinforcing a possible uptrend as sentiment stays contrarian.

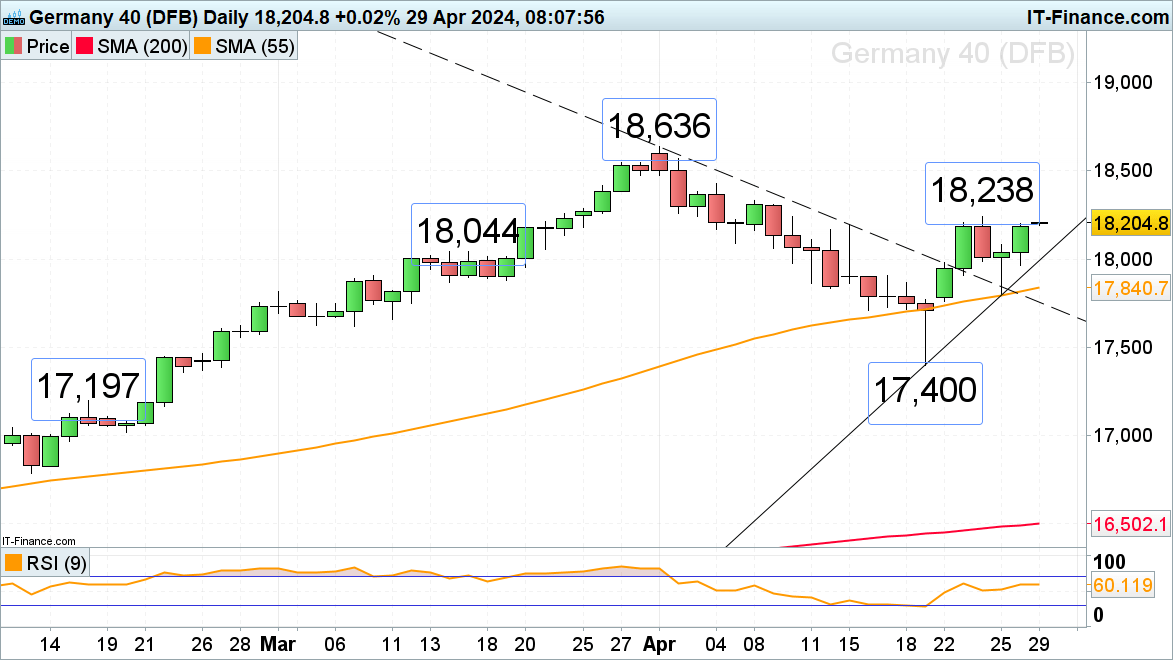

DAX 40 Beneficial properties on Constructive Tech Earnings

The DAX 40 has rebounded from current lows, propelled by favorable US tech earnings. It has revisited final week’s peak at 18,238, which quickly acts as resistance. The index is eyeing the 18,500 stage as the subsequent key goal.

Any pullbacks are anticipated to search out help between the mid-March excessive and the April uptrend line, starting from 17,994 to 18,044.

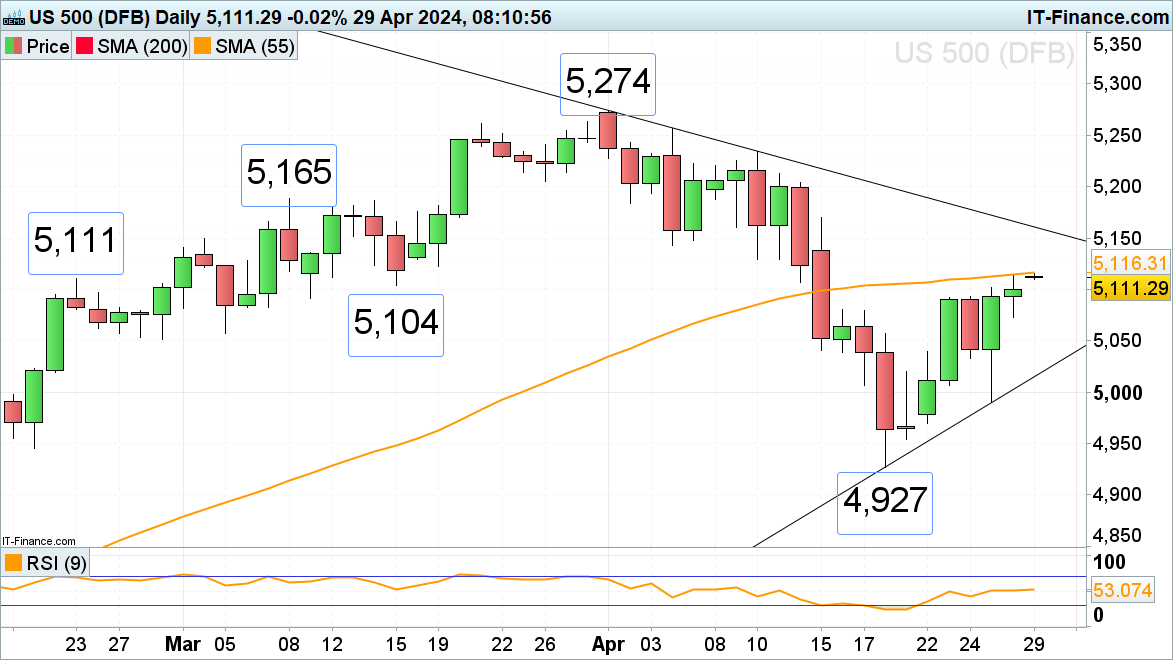

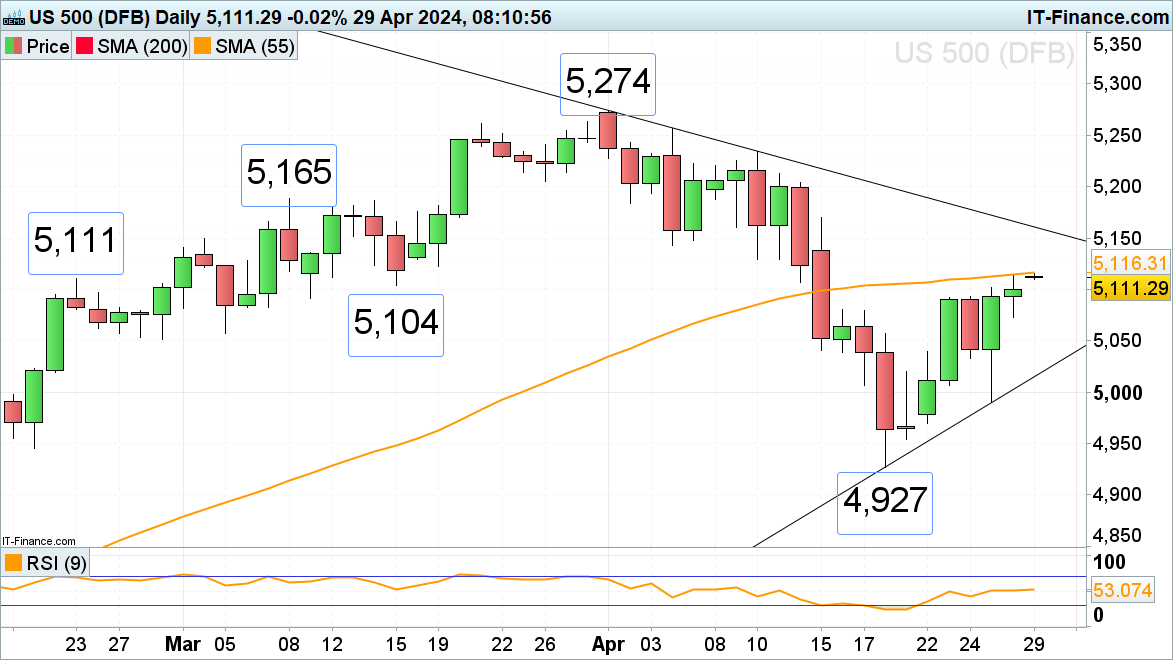

S&P 500 Continues Its Upward Pattern

The S&P 500 resumed its climb, attaining one of the best weekly efficiency since November 2023, pushed by robust US earnings. It reached the 55-day SMA at 5,116, which beforehand served as resistance. At present, it targets the April downtrend line at 5,161. Strong help is established close to the current highs of 5,092 and final Friday’s low of 5,073.