Gold Worth and Evaluation

Final week’s buying and selling periods skilled a extremely unpredictable gold market, as costs surged to succeed in a new document excessive earlier than present process a notable decline, in the end ensuing within the metallic’s worth remaining comparatively secure for the week.

This unstable motion was primarily pushed by the Federal Reserve’s indication of a potential 75 basis-point discount within the Fed Fund fee for this yr, reiterating their earlier remarks. After Fed Chair Powell’s optimistic remarks, gold briefly surged to new ranges.

Nevertheless, the rally rapidly fizzled out because the US greenback strengthened, particularly following the Financial institution of England’s coverage assembly. This induced the Euro and British Pound to weaken, placing downward strain on gold costs.

In gentle of the stronger USD, US bond yields have been steadily declining attributable to anticipated changes within the Fed Fund fee.

Given the latest lower in yields, particularly for the US 2-year and 10-year notes, which noticed declines of 14 and 11 foundation factors respectively, there’s a risk that gold costs may improve, doubtlessly reaching final Thursday’s all-time excessive.

Market Technicals and Dealer Sentiment

The gold market is displaying indications of a bullish setup after a bullish pennant sample was shaped final week.

The present sideways buying and selling may doubtlessly transition right into a bullish flag sample, to surpass $2,200/oz. and doubtlessly testing the all-time excessive of round $2,225/oz. There appears to be some preliminary assist slightly below the $2,150/oz mark.

In line with retail dealer knowledge, most merchants at present maintain net-long positions, indicating a typically optimistic sentiment. Since March 1, when gold was buying and selling close to $2,082.75, its value has skilled a 4.24% improve.

There was a noticeable rise in net-long positions compared to net-short positions.

Latest Gold Worth Actions

The value of gold continued to rise, surpassing $2,150 throughout early Asian buying and selling hours on Tuesday. This improve was pushed by the anticipation of rate of interest cuts and the dovish remarks made by Federal Reserve officers.

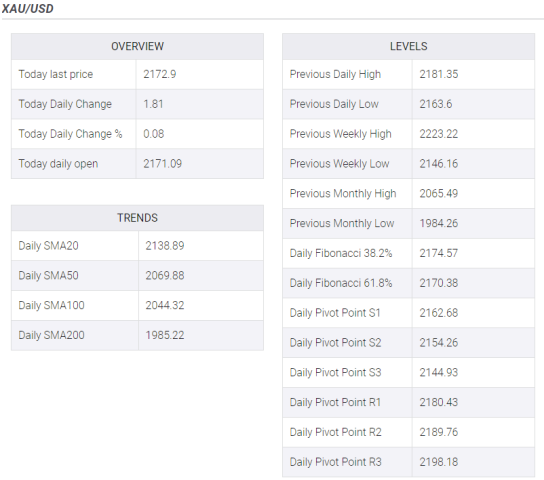

At current, the worth of gold stands at $2,171, indicating a modest uptick. This improve happens because the US Greenback Index (DXY) declines and there are small enhancements in US Treasury bond yields, particularly the 10-year yield at 4.25%.

Traders are carefully monitoring upcoming financial indicators, together with the US Private Consumption Expenditures Worth Index (PCE) for February, to realize insights into the potential timing of fee cuts.

Evidently the market has already factored in a fee reduce by June, particularly after the Fed’s March assembly.

Geopolitical Tensions

Given the present geopolitical panorama, with Russia’s elevated aggression in the direction of Ukraine and ongoing tensions within the Center East, it’s doubtless that buyers will flip to gold as a safe-haven funding.

These latest developments, together with essential US financial experiences scheduled for this week similar to Shopper Confidence, Sturdy Items Orders, and GDP knowledge, are anticipated to have an effect on the short-term trajectory of gold.

Remaining Ideas

The gold market is at present at a vital level, as a number of components are exerting conflicting influences on it. On one hand, the changes in Federal Reserve coverage and geopolitical tensions provide vital assist for costs.

Nevertheless, the US greenback’s power and the consistently evolving international financial panorama current some challenges.

As merchants navigate this advanced surroundings, the opportunity of reaching a new all-time excessive nonetheless exists, relying on the unfolding financial knowledge and geopolitical developments.

Given the present state of the market, people should keep well-informed and attentive to take advantage of the potential adjustments in gold’s worth.