This week is predicted to be low-key till Wednesday, with hardly any important information factors till then. The important thing occasions embrace the 20-year Treasury public sale, the launch of Fed minutes, Nvidia’s earnings, and the expiration of VIX choices, all scheduled for Wednesday. Previous to that, Monday and Tuesday are anticipated to be comparatively quiet.

For followers of the Federal Reserve, there’s a lot to sit up for. Raphael Bostic is ready to make a number of appearances, beginning with an interview on Bloomberg TV at 7:30 AM ET on Monday, adopted by remarks on the Atlanta Fed Monetary Markets Convention at 8:45 AM, and ending the day with a panel at 7 PM ET. His engagements proceed into Tuesday and Thursday, providing quite a few insights into Fed insurance policies.

Fed Governor Chris Waller may even be energetic this week, discussing the financial outlook on Tuesday and the idea of _R—the impartial rate_**—on Friday. His feedback may point out the next than anticipated R, reflecting on current market dynamics.

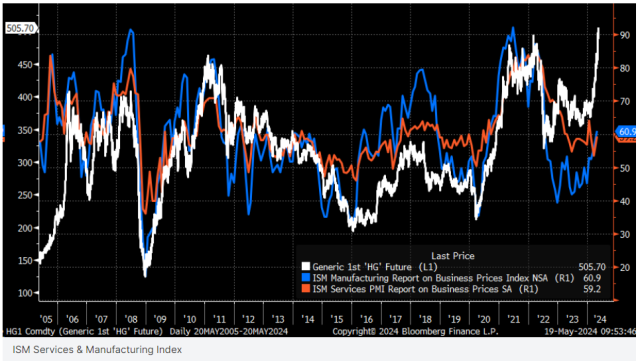

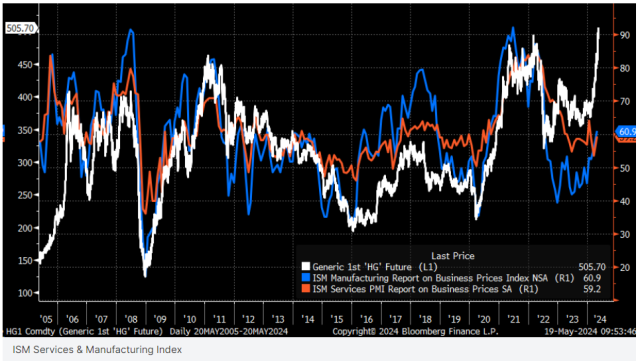

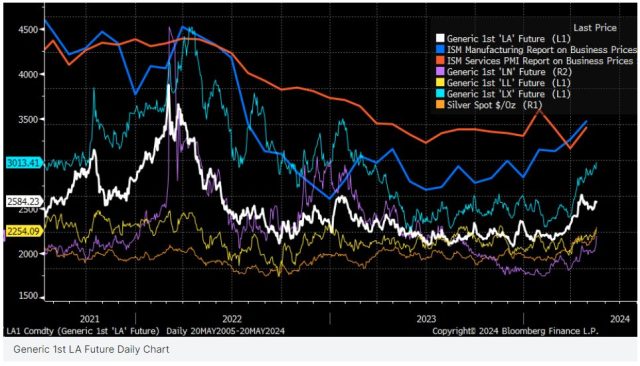

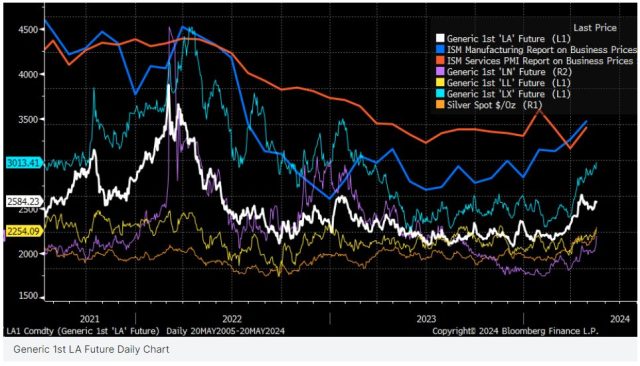

Within the commodities market, copper costs have surged to over $5, a close to 40% enhance since early February, signaling potential inflation pressures. This rise in commodity costs, together with silver, lead, zinc, and nickel, hints at broader market traits that would impression inflationary expectations.

The current efficiency of oil costs additionally warrants consideration. Oil has damaged a downtrend in its RSI and maintained help at $78.50, suggesting a doable upward motion in direction of $85, which may additional affect inflation charges and 10-year yields. These are carefully tied to grease value actions, with the 10-year charges prone to rise if oil costs climb.

Even gasoline exhibits indicators of an upward pattern, with a break in its downtrend RSI and a rebound in value, finishing a head and shoulders sample.

Equally, pure fuel costs are on the rise, showing to breakout, which aligns with bullish traits within the power sector, notably seen within the XLE inventory index displaying indicators of a bull flag sample.

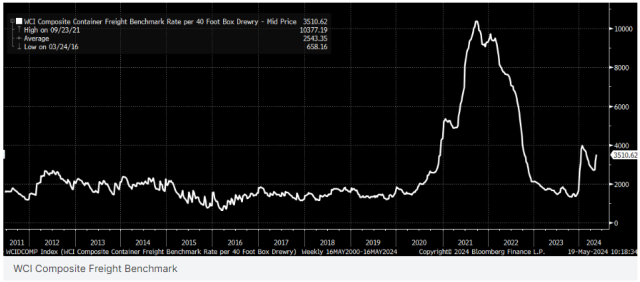

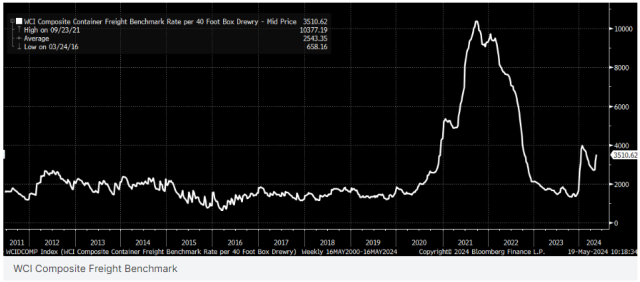

That is additional corroborated by a current enhance in transport charges, as per the WCI Composite Freight Benchmark, suggesting that metallic costs and transport charges are transferring in tandem with power costs.

All these components mixed—the actions in commodities, power costs, and transport charges—recommend that inflation charges may climb within the coming months, doubtlessly difficult the notion that present financial coverage is sufficiently restrictive.

With Chris Waller’s commentary on R* this week, buyers ought to pay shut consideration as his insights may reveal whether or not the Fed’s present coverage settings are ample to sort out the approaching inflationary pressures.

As markets react to those indicators, the monetary panorama appears to be like set to shift, prompting a reassessment of present financial methods and investments.

In the end, the fruits of those financial indicators signifies a pivotal week forward, as buyers and policymakers alike gauge the potential for adjustments in market circumstances and coverage changes.

This evaluation goals to offer buyers with a concise overview of the pivotal occasions and market indicators for the week, highlighting the potential shifts in market dynamics and coverage implications.